In terms of exploring the experience of automotive central screen and the service ecology derived from it, the Chinese are considered to be at the forefront of the world.

The car operating systems of Dongfeng Aeolus WindLink3.0, Geely GKUI, and a large number of new car companies that have been launched one after another can easily surpass the experience of high-end models of joint venture car companies. And the leader among these operating systems is the Banma Intelligent Vehicle Operating System based on AliOS.

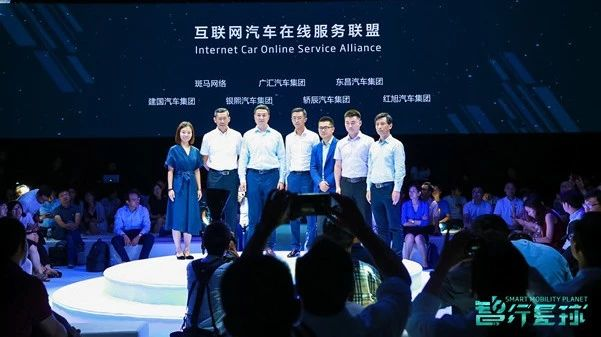

A few days ago, Banma held the 2018 Banma Intelligent Vehicle Exploration Conference in Shanghai and announced two things: the official release of AR-Driving, and the establishment of the Online Service Alliance (OSA) with numerous automotive service providers.

I won’t go into detail, but you can see that this is no longer just about the central screen. Since the launch of the Roewe RX5, the first car model equipped with Banma’s interconnected car system on July 6, 2016, Banma’s interconnected vehicle ownership has exceeded 700,000 today. Therefore, Banma has already gone beyond the stage of perfecting basic functions and has begun to make efforts in a more macroscopic ecological area.

Speaking of 700,000 vehicles, this is not a small number. The key reason why Banma, an experimental project incubated by SAIC Ali, quickly developed into an ambitious platform company is that Banma has taken very few detours. Some of the initial interaction principles of AliOS, such as “map is desktop”, “app-free” and “deeply cultivated voice interaction”, are now the industry standards for the entire car operating system.

Let’s talk about AR-Driving, which is the industry’s first augmented reality navigation/ADAS product. It will debut on the popular SAIC Roewe Marvel X. Banma’s point of view is that the most significant significance of AR-Driving is to improve safety, in addition to the improved navigation experience.

Banma’s chief scientist, Shi Xuesong, once told the media that when a person drives a car, it takes about 1 second for the eyes to look at the central control and return to the front view, which is called “blind fly” time;looking at the instrument panel and returning to the front view requires 0.5 seconds; looking at the HUD (Head-Up Display) and returning requires 0.2 seconds. AR-Driving, in actual presentation, is a HUD based on AR technology. Therefore, information acquisition is carried out in real-time, and the blind fly time is 0 seconds.The Zebra AR-Driving includes two parts, AR navigation and AR ADAS, in addition to basic navigation, it also has active safety functions such as turn signal reminders, high-speed entrance and exit reminders, and lane departure warnings. Although it doesn’t seem like a complex product, it involves the integration of multiple interdisciplinary technologies, including maps, high-precision positioning, computer vision, and ADAS algorithms.

Zhou Ping, the senior vice president of Zebra, is confident that AR is the ultimate form of navigation. We can also look forward to the feedback from Marvel X car owners, and here is a video for now:

XinIMa

Another thing is that Zebra has established the Internet automotive online service alliance (OSA) with Guanghui Automobile, Dongchang Automobile, Jianguo Automobile, Yinhui Automobile, Jiao Chen Automobile and Hongxu Automobile. By simultaneously connecting cars, people, and services online, they aim to achieve the overall output of platform technologies and services from accounts to location, voice, cloud services, and payment.

This is not the first time that Zebra has done a similar ecological layout. In December of last year, Zebra formed an alliance with six other car networking service providers (TSP), including Timacheyi, Cheyin.com, Unicom Network. When interviewed, Zebra CEO Hao Fei mentioned that automotive parts suppliers such as Bosch, Continental, Visteon, Delphi, and Desay SV are also strategic partners of Zebra.

In fact, by the end of last year, the number of companies that have cooperated with Zebra to build an Internet automotive ecosystem has reached 66. Their business covers TSP, software solution providers, chip manufacturers, smart hardware, car insurance, transportation, rescue, communications and entertainment, accounts, cloud platforms, catering, and more.

At this point, you may have noticed some of Zebra’s operational strategies. This is a typical approach of a platform-based company. To create intelligent vehicles, their foundation is to implement an account system + OTA + cloud services. Two years ago, Zebra became the first company in China to launch a similar product after Tesla, and they have been trying to turn Zebra into an ecosystem over the past year.

At the Alibaba Cloud Conference in October of last year, Zebra announced its second OEM partner, Shenlong, after SAIC. Since then, Ford and Guanzhi have also joined. This is an openness in terms of business.“`

Another round of financing will be announced by Pony.ai later this year. New investors will accelerate Pony.ai’s socialization and platformization from the capital perspective. Confirmed investors include Guotou Innovation and Yunfeng Fund. If Yunfeng Fund, as a joint founder, belongs to Ali系 private equity funds, Guotou Innovation, which invested in BYD and CATL, is relatively pure intelligent vehicle industry capital. This also fulfills the concept that the AliOS management has always emphasized, “AliOS does not belong to SAIC or just Ali, but is open to the entire industry and serves automakers worldwide.”

To be frank, the landing of those in-car systems at the beginning of the article shows that it is difficult but not impossible to integrate the Internet and traditional automobiles. Pony.ai’s advantage lies in being at the starting line 12 to 18 months earlier. This first-mover advantage has allowed Pony.ai to stay ahead of the industry.

Don’t underestimate this half-step advantage. The number of Ali-Pony cars has exceeded 700,000, up from 600,000 only a month ago at last year’s Alibaba Cloud Summit. As Pony.ai is installed on more and more car models, the growth rate of this number will accelerate, and on the other hand, voice interactions and the seamless and natural scenario-based interaction advocated by Pony.ai both extremely depend on the large-scale feeding of data, and interaction optimization will in turn promote sales growth.

On the other hand, it’s not entirely good news that such a young company has already built a barricade. The subtlety of the situation lies in the fact that Baidu, with Xiaodu OS, and Tencent, with AI in Car systems, have also entered this race. We’ll have to wait and see whether Pony.ai’s lead of half a step in the industry can turn into a full step or not.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.