It is not easy to be a new car company. On one hand, you need to integrate a good Internet team and a traditional engineering and manufacturing team to survive among the hundreds of new car companies that have emerged in the past two years. On the other hand, from the perspective of the industry trend, each founder must consider how to establish the core technology building of autonomous driving, the future core technology of the automotive industry.

In my observation, NIO, XPeng, and CHJ Automotive are the three players who have invested more in the autonomous driving field among the new car companies. If this causes dissatisfaction among other companies, please leave a message in the comment section, and I will come up with a sequel.

NIO

Since its founding, Li Bin, the founder of NIO, has always been respectful to technical talents. He first uses dreams to move them emotionally. If they are still unwilling to come to NIO to change the world, he can only explain it with high salaries.

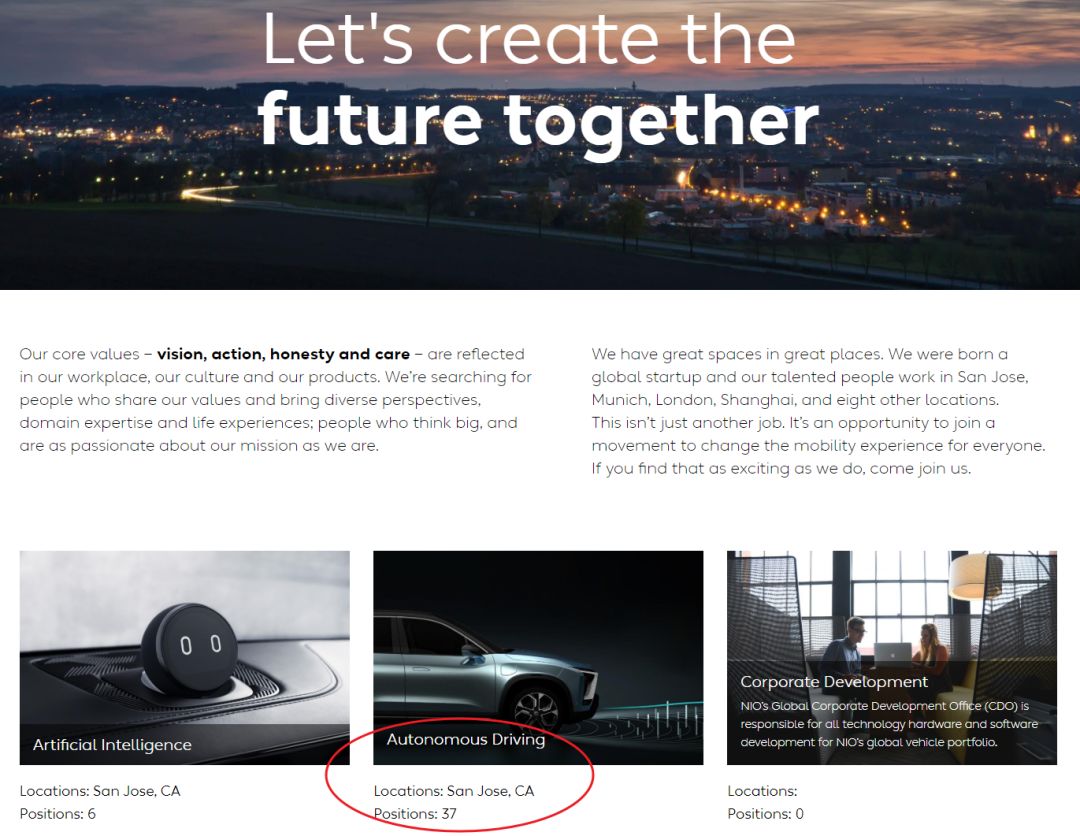

NIO’s autonomous driving and vehicle networking team is located in Silicon Valley and is led by Padmasree Warrior, NIO’s Chief Development Officer and CEO of North America. On March 10, 2017, at the South by Southwest (SXSW) conference in the southwestern United States, Warrior spoke for the first time on behalf of the North American team. NIO will launch autonomous driving cars for American consumers in 2020.

However, in fact, the North American team was formed as early as 2015. It is worth noting that NIO was officially established in November 2014. Therefore, although autonomous driving burns money and resources, Li Bin has invested in it very early without hesitation.

Let me introduce two technical leaders of NIO’s North American team:

First, there is Jamie Carlson, whose title is Vice President of Autonomous Driving at NIO. His resume is very impressive. Before joining NIO, he was a member of Apple’s Project Titan team for autonomous driving cars, and before that he was the firmware manager for Tesla’s Autopilot. His former colleagues praised him, saying “He is a great team player. He pays attention to every detail, works very hard and produces a good quality code.”

NIO is most interested in recruiting talents with rich experience and a good reputation like him.Another Vice President of Artificial Intelligence at NIO is Chris Pouliot. Prior to joining NIO, he served as Director of Algorithm and Analysis at Netflix, and later as Vice President of Data Science at Lyft. He is now responsible for the application of artificial intelligence in personalization, logistics, and autonomous driving in NIO North America.

On October 14, 2016, NIO announced its acquisition of the 16th autonomous driving license from the California Department of Motor Vehicles (DMV), ranking ahead of Apple, Toyota, and Intel.

At that time, the North American team had already expanded to 300 people. By the beginning of this year, it further expanded to 400 people. If you take a look at the NIO North America website, there are still 37 autonomous driving-related positions open for a long time.

On February 23, 2017, the NIO EP9, an electric supercar and driverless car, set a speed record of 257 km/h in driverless tests at the Circuit of the Americas in Texas, becoming the world’s fastest driverless car.

You might say, what’s the use of a fast driverless car? It is useful indeed. Generally speaking, new car manufacturers and start-up companies specializing in driverless technology excel in software and algorithms, but fall short in vehicle chassis and power control. The successful implementation of turns and gear changes under high-speed scenarios by the NIO EP9 demonstrates the team’s breakthroughs in areas where they are not proficient. This kind of technological accumulation can also be extended to the advanced driver assistance systems of mass-produced cars such as the ES8 and the ES6 in the future.

After the release of ES8, the media also captured an ES8 driverless test vehicle near Montague highway in California.

# Introduction

# Introduction

NIO has created a record with the ES8 mass-produced vehicle that features an advanced driver assistance system with the world’s first Mobileye EyeQ4 chip. Many people are curious as to why NIO did not talk much about the NIO Pilot advanced driver assistance system when delivering vehicles. In fact, the EyeQ4 chip was launched in late 2017, around the same time as the release of the ES8. Before the mid-year delivery this year, NIO had to test the performance of this expensive chip, adapt and iterate algorithms and functionalities, and then push them to users through OTA updates.

Sound familiar? Tesla did the same thing. However, Tesla Autopilot 1.0 used Mobileye’s EyeQ3 chip, and the EyeQ4 chip’s performance is 8 times higher than the Q3’s, with only a 20% increase in power consumption.

NIO Pilot is equipped with 1 triple camera, 4 surround-view cameras, 5 millimeter-wave radars, 12 ultrasonic sensors, and 1 driver status detection camera, which is comparable to AP 2.0 in overall specifications.

NIO released a promotional video introducing the NIO Pilot:

In summary, NIO is basically following a two-pronged approach in the field of autonomous driving. On the one hand, it is committed to the application of advanced driver assistance systems in mass-produced vehicles, collecting data through the OTA system in real road conditions to continuously improve algorithms. On the other hand, it is also developing L4 level autonomous driving technology.

XPeng

In an interview on CCTV-2’s “Dialogue” program a few days ago, He XPeng mentioned that the automatic parking function of XPeng Motors would be a special highlight. This was the nth time that He XPeng had promoted XPeng Motors’ parking function.

The automatic parking function is no longer new in luxury car models. However, He XPeng believes that the current automatic parking function in many scenarios is not user-friendly enough. XPeng hopes to increase the frequency of automatic parking to 70%-80% or even higher.

Here is a promotional video for XPeng’s automatic parking:

This strategy embodies XPeng’s approach to advanced driver assistance, which is essentially consistent with Tesla and NIO. They both collect road condition information and validate and optimize algorithms based on the whole vehicle OTA system.

Gu Junli, the Vice President of Automatic Driving at XPeng, is the former head of Tesla’s Autopilot machine learning. Therefore, XPeng’s high-level advanced driver assistance system inevitably includes some features from Tesla but also undergoes many localized R&Ds for the road conditions in China.

For example, in terms of team building, Gu Junli said in an interview with Xinzhi Drive that XPeng’s autonomous driving team has several rules:

“stay small”, small-scale;

“stay focused”, very focused, making everyone’s brain into a larger super brain;

“stay open-minded”, using independent thinking to solve problems;

“move fast”, moving quickly.

It sounds very much like Tesla. The reason why XPeng’s Silicon Valley autonomous driving team has only about 50 people is thanks to Gu Junli’s talent recruitment style that follows the “quality over quantity” principle of Tesla.

However, due to localized R&D for China, there will be significant differences in user experience between XPeng’s system and Autopilot. For example, targeted solutions must be developed for common issues on Chinese roads, such as sudden lane cutting, emergency braking, and unexpected obstacles like motorcycles, electric bicycles, and pedestrians.Tesla Autopilot doesn’t have a development team in China. The positions related to Autopilot are called Autopilot Product Support Engineers. These engineers need to test Tesla with new algorithms in various road conditions every day and give feedback on bugs to the headquarters in California. Compared to some new local car companies rooted in China, this iteration is not optimistic in terms of efficiency.

In terms of technology, Gu Junli once said that technology should break through first, forming a line, then forming a surface, and finally forming a framework. The G3 launched this year has automatic parking, automatic follow-up, automatic overtaking and remote summoning, which specifically solve the three scenes of getting, using, and parking.

My understanding is that XPeng will break down the entire autonomous driving scenario into functional breakthroughs one by one, gradually iterating to form a relatively complete advanced driving assistance system through OTA.

In terms of hardware, the XPeng G3, which will be delivered in the second half of this year, is equipped with 12 ultrasonic radars, 3 millimeter-wave radars, and 5 cameras, which is similar to Tesla and NIO. It can be seen that one subtle difference is that Tesla relies more on cameras and is very aggressive on the visual route; while NIO and XPeng are more balanced in the fusion of cameras and millimeter-wave radar perception.

XPeng has not disclosed the computing platform of the G3, but to carry so much sensor perception data fusion, planning decisions and control, the computing platform cannot be too weak. Gu Junli’s saying is a “high-performance, low-latency computing unit.”

XPeng has already started to lay out the future in advance. On June 23rd, XPeng and automotive electronics supplier Desai Xiwei reached a cooperation to jointly develop L3-level autonomous driving cars, which is expected to be put into mass production in 2020.We have written about Desay SV before, which has been involved in the fields of whole-vehicle OTA, cameras, millimeter-wave radars, and whole-vehicle body networks.

XPeng has reserved Desay SV’s vehicle-grade autonomous driving domain controller that meets ISO 26262 road safety regulations in the design, claiming that it is equipped with “top-level AI supercomputing chips internationally.” From the perspective of performance and power consumption balance, application-specific chips for autonomous driving cars are the trend. EyeQ4 carried by NIO ES8 and Chehejia SUV as well as AI chips self-developed by Tesla all belong to some extent to application-specific chips.

Regarding level 3 autonomous driving cars in 2020, XPeng’s definition is to provide three major functions: low-speed valet parking, mid-speed traffic jam pilot, and high-speed autonomous driving. Compared with the L2-like L3 of the new Audi A8, XPeng’s L3 sounds more like L4. It is worth looking forward to.

In summary, XPeng’s and NIO’s autonomous driving fields are consistent in strategy, that is, to walk on two legs, promote the application of advanced assistive driving systems in mass-produced cars, collect real-road conditions data with the help of whole-vehicle OTA, and continuously improve algorithms; and develop L4-level autonomous driving technology at the same time. The differences lie in specific tactical implementation.

Chehejia

It is difficult to write about Chehejia’s autonomous driving, not only for autonomous driving, but also for all businesses. This company is not as high-profile as a newly established automobile company. Finally, it made headlines, and it was surprisingly because Li Xiang sent an email to all staff.

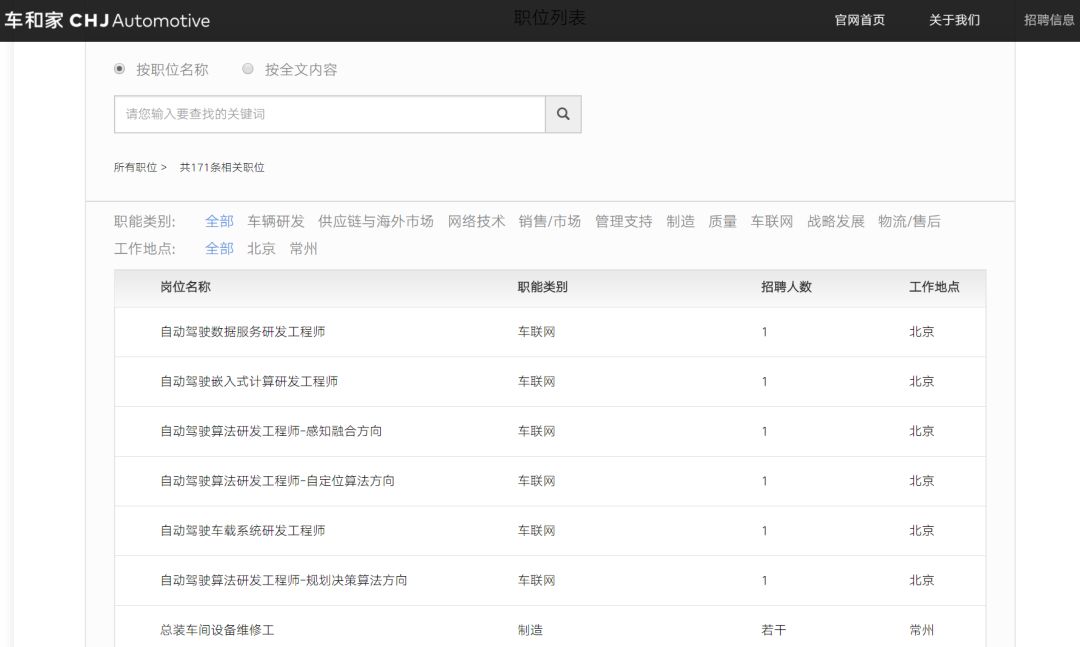

On June 28, 2018, at the Intelligent Automobile Cross-border Integration Summit, Chehejia’s autonomous driving director Lang Xianpeng publicly announced for the first time the autonomous driving strategy of Chehejia. Chehejia plans to achieve the commercial operation of L4-level autonomous driving cars by 2025.

Before entering Chehejia, Lang Xianpeng worked at Baidu, where he was an early employee of Baidu L3 Business Unit and had been promoted to a senior technology manager. Currently, he leads a team of about 10 people to develop the advanced assistive driving system for Chehejia’s first SUV.

Doesn’t it sound like Chehejia is inferior to the previous two companies? In fact, there are still differences in specific tactical implementation. When you open its official website, the strategic layout page is all about investing in the autonomous driving industry chain and application scenarios.

EasyAccess Intelligence, for example, uses a hardware solution consisting of millimeter-wave radar, ultrasonic radar, cameras and controllers to achieve Tesla Autopilot-level autonomous driving capabilities while keeping costs below $1,000.

Why emphasize $1,000? Car and Home has a different approach from Tesla, NIO and XPeng: Li Xiang said in an interview with the media that Car and Home’s SUV will be the world’s first model with L2-L3 autonomous driving as standard, without the need to spend an additional RMB 50,000-100,000 like Tesla and Audi.

Since it is not optional, it is important to keep costs at a reasonable level while ensuring performance.

Specifically, although Car and Home SUV has not yet been released, it can be roughly estimated based on Tesla, NIO and XPeng. 12 ultrasonic sensors are distributed on the front and rear of the body, about 5 millimeter-wave radars, about 5 cameras, and a Mobileye EyeQ4 chip.

Completely benchmarking Tesla Autopilot, with a fusion control algorithm developed for Chinese road conditions, completing 350,000 kilometers of road testing, making optional standard, will significantly improve the product strength of Car and Home SUV.

Car and Home chose to independently develop L4 autonomous driving technology. Rumor has it that this year Car and Home will establish a new company in Silicon Valley dedicated to L4 research and development, and relevant recruitment has already begun.

In addition, there is also Luminar, which produces a 128-line rotary lidar. This approach is quite interesting. The entire lidar industry has transitioned from rotary to solid-state, using multiple low-line-count lidars to replace a single high-line-count lidar to address reliability and cost issues.The seemingly counter-trend behavior of Flow Deep Photonics has attracted investment from industrial investors such as Cheha and Jia. We can look forward to the novel strategies that these two companies will bring about through cooperation.

Summary

Overall, I hold an optimistic attitude towards the commercialization of self-driving cars by new automakers. From a data perspective, training algorithms for L4 autonomous driving cars using the tens of thousands of real-world driving data collected is almost the only path towards improvement. This scale can almost eliminate all independent autonomous driving start-ups. From a talent and strategic perspective, new automakers’ emphasis on and investment in autonomous driving far exceeds that of traditional automakers.

Are you ready to commute in intelligent cars from new automakers in 2025?

-

How do you see the autonomous driving arms race stirred up by General Motors’ Waymo?

-

Do you really think autonomous cars are just around the corner?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.