After being successively invested by Middle East oil consortium, Indian veteran automaker Mahindra, Thailand National Petroleum Corporation (PTT), a mysterious state-owned enterprise, Li Jiacheng’s eldest son Li Zeju, Hong Kong hidden rich Zhao Du, and Jia Yueting himself with a “huge investment”, Faraday Future, the most imaginative intelligent electric vehicle start-up company had finally confirmed their massive financing. Today, Evergrande Health announced that the company will invest a total of $2 billion to acquire a 45% stake in FF before the end of 2020.

FF announced the financing information on official Twitter, Weibo and WeChat for the first time. The announcement reads: “After obtaining approval from the US government, FF has completed the first round of financing of $2 billion!”

Have you ever seen a company put the approval from the government at the forefront when announcing financing?

Since Jia Yueting resigned as chairman of LeTV.com in July last year and devoted himself to car-making, FF’s business reputation has been continuously eroded by a series of financing smoke bombs. It happened that when the real financing news was announced, they had to use the approval of the Committee on Foreign Investment in the United States (CFIUS) to give themselves an endorsement.

In any case, the approval by CFIUS is a real thing, and a financing of $2 billion is also a fact. As a Hong Kong-listed company, the credibility of Evergrande Health’s investment announcement need not be worried. However, considering FF’s bad experience in disclosing financing information, the analysis below will still be based on Evergrande Health’s announcement.

$2 Billion? HKD6.7467 Billion?

It has to be said that the design of this acquisition plan is very clever, and you can even see the traces of the bargaining game between the two parties.

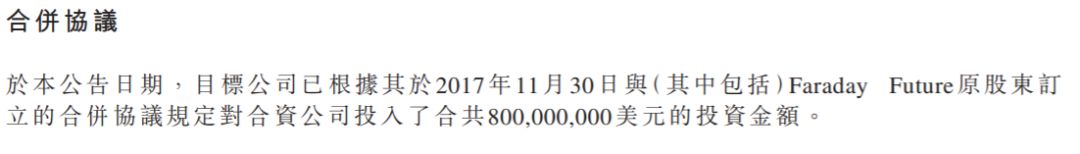

Evergrande Health has acquired 100% of the shares of HK Times Electric Vehicle Investment Holdings Limited (HKTE) for HKD6.7467 billion. The announcement says that on November 30, 2017, HKTE and the original shareholders of FF established a new company called Smart King Ltd., in a joint venture mode. TE agreed to invest $2 billion to obtain 45% of the joint venture company’s shares, while the original shareholders of FF entered into the joint venture company with FF’s technical assets and business to obtain a 33% stake, with the remaining 22% reserved for distribution to employees based on an equity incentive plan.

How Evergrande Health took up the 45% stakes of FF is shown in the following picture by Sina Technology.

Let’s continue to talk. The announcement also disclosed the seller of this acquisition: Zhao Du. In other words, Zhao Du was the actual controller of Hong Kong Time Youth, which was mentioned at the beginning of this article. Therefore, Zhao Du’s investment in FF was indeed true.

However, did Hong Kong Time Youth and FF really plan a staged investment plan of 2 billion US dollars at the end of 2017? It is very likely that they did not.

Since the end of last year, FF has continuously released news to the media: FF has completed a $1 billion A round of financing. Especially at the FF internal employee meeting on December 13, 2017, US time, Jia Yueting personally told the core staff of FF under the stage that FF had completed more than $1 billion A round of financing, and he himself would serve as FF’s global CEO and chief product officer.

Have they reduced the financing plan of 2 billion US dollars to 1 billion US dollars internally and externally? It is unlikely. It is more likely that FF had reached a financing plan of less than 1 billion US dollars with Hong Kong Time Youth at that time.

How much money was actually invested? According to the data disclosed in the announcement, Hong Kong Time Youth invested 800 million US dollars in FF, and Evergrande Health took over at HKD 6.7467 billion, which is equivalent to 821.52 million US dollars according to today’s exchange rate. Investing 800 million US dollars for 7 months and earning a profit of 21.52 million US dollars, how was Mr. Zhao Du’s return on investment?

Next, let’s talk about the new plan of 2 billion US dollars. According to the agreement, Evergrande Health will invest 600 million US dollars to FF before the end of 2019 and the end of 2020, in addition to the 800 million US dollars this time, which makes a total of 2 billion US dollars.

“`

“`

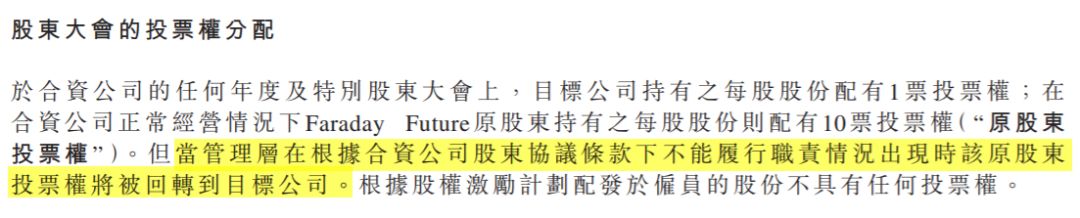

Meanwhile, the joint venture company adopted an A/B share system to protect Jia Yueting’s controlling rights in the distribution of voting rights. Evergrande Health holds 45% of the shares, with 1 vote per share, while Jia Yueting and FF management hold 33% of the shares, with 10 votes per share. The remaining 22% of the shares, which will be issued to employees as part of the equity incentive plan, do not have voting rights.

A simple calculation shows that Jia Yueting’s voting rights have reached 88%, while Evergrande only has 12%. I am particularly curious about how many shares were obtained by the FF management team that came out of Tesla and General Motors to start a business with Jia Yueting?

Of course, Xu Jiayin also has conditions.

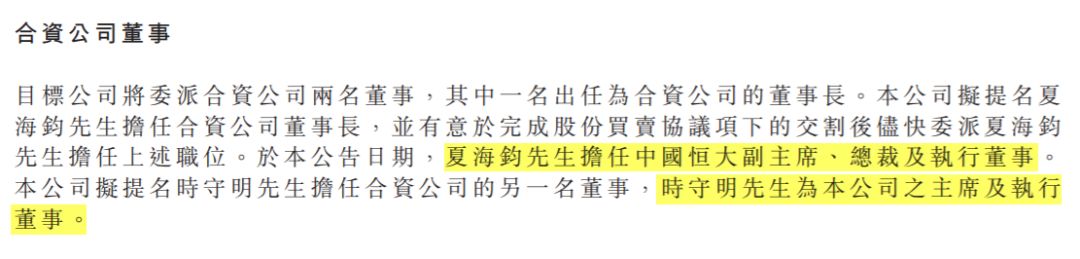

First of all, Xia Haijun, the vice chairman of Evergrande Group’s board of directors, president and executive director, and Shi Shouming, the chairman, president and executive director of Evergrande Health, and former president of Evergrande Real Estate, were parachuted into Smart King Ltd, respectively serving as chairman and executive director.

Secondly, the announcement states that “when (FF) management is unable to perform its duties under the terms of the joint venture company shareholder agreement, the original shareholder’s voting rights will be returned to the target company (i.e. Hong Kong Ideal).”

It is a demanding clause, which can even be said to give Evergrande the ultimate veto power. However, considering Jia Yueting’s track record during the LeEco period which caused a substantial negative impact on his business reputation, Evergrande’s preparations can be understood. The announcement does not specify what constitutes “failure to perform duties”? For example, if Jia Yueting fails to meet his promise of delivering the FF91 by the end of this year, does it count?

Is FF making a comeback?

We cannot ignore the remarkable product capabilities of FF91 and the modern management team of FF, and their potential impact on China’s automotive industry is significant.

But let’s face the financial reality. The plan above is quite apparent. In fact, this acquisition only transferred the 33% equity held by Zhao Du to Evergrande. The two subsequent payments of $600 million cannot be expected in the short term.

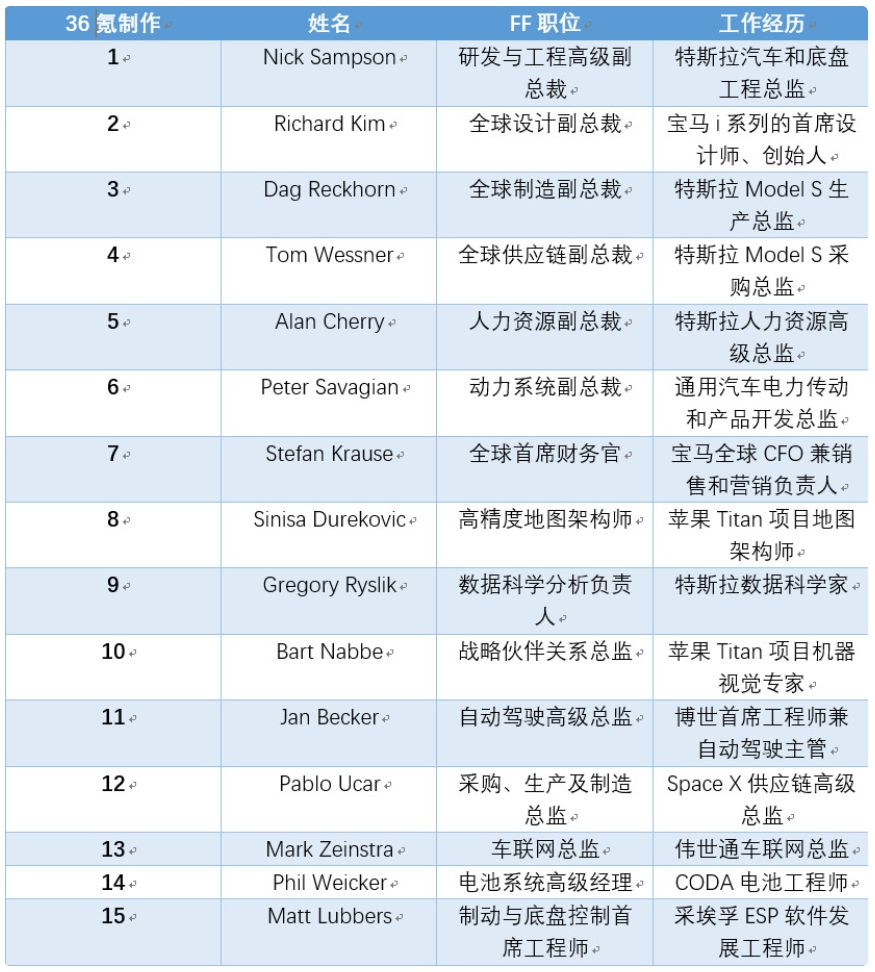

Jia Yueting previously mentioned in an open letter that he had used over 10 billion RMB of his own funds in the FF project. Can the $800 million ensure the establishment of a factory with a production capacity of tens of thousands of vehicles and the delivery of products? It’s doubtful given FF’s previous track record. If they spare no effort to take the path of Tesla and clear suppliers and cut 9% of the workforce, there may be an opportunity, but it is not certain how much impact it will have on the mass production and delivery of the FF91.Then there is the team aspect, which is a topic that is painful and regretful. FF had surpassed NIO in attracting top talents in the automotive industry before. Look at this chart compiled by 36Kr, which shows that during FF’s peak period, about 70% of its executives have left FF, including core executives such as design vice president, global supply chain vice president, and chief financial officer, who participated in the creation of the FF91.

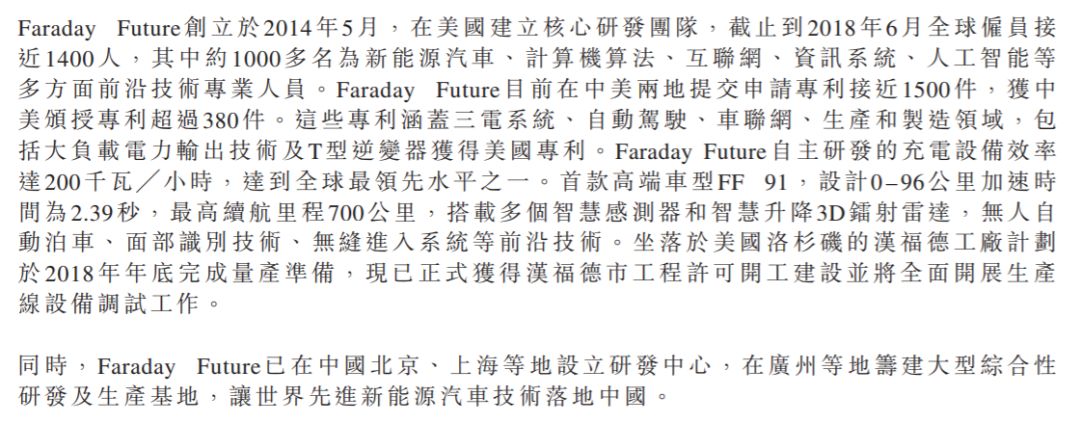

According to the announcement by Evergrande Health, as of June, FF had nearly 1400 employees worldwide, with a research and development and manufacturing team of over 1000 people. By the end of last year, NIO had already exceeded 4000 employees. FF’s data can no longer squeeze into the top tier of new carmakers.

Finally, we come to mass production. Let’s put aside FF’s factory in Nansha, Guangzhou for now. The Guangzhou Public Resource Trading Center website clearly states that even if construction starts within one month after the land transfer, it still takes 24 months to complete and put into production. Distant water cannot quench present thirst.

On June 7, FF announced that the construction work of the Hanford factory in California would be contracted to Bernard, a commercial construction company in California. Falco DiGiallonardo, vice president of Bernard, said, “We will work together with FF to ensure that the factory achieves mass production of FF 91 within the year.”

This statement confuses me very much. The NIO-JAC factory, which set a record for construction speed in the industry, took nearly 13 months to complete the entire production line. Even if FF started construction this month and is building while producing, it is almost an impossible task for FF’s production and manufacturing team to achieve mass production within the year.

The most critical issue is that in 2016, before the CES, FF had an ambitious plan to build a $1 billion factory, matching product plans and delivery schedules. However, due to financial constraints, the negative impact on Jia Yueting’s personal credibility had already emerged in Evergrande’s investment plan, and FF’s commercial credibility among global suppliers will further affect the mass production of FF91?

The glory of Jia Yueting’s return as a king has not yet arrived. We can only say that FF has already gone through the most difficult period. Starting a business is not easy, it’s the same for Tesla, NIO, WM Motor, Xpeng, and FF.## English Translation with Markdown

Of course, although “the revolution has not yet succeeded” [a quote from Mao Zedong], every entrepreneur who devotes their all to creating new vehicles deserves a little respect. Do you remember how, in 2014, at the LeEco executive meeting, most executives were firmly against making cars, yet [Jia Yueting] said: “Even if LeEco making cars means we won’t survive, I have no regrets.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.