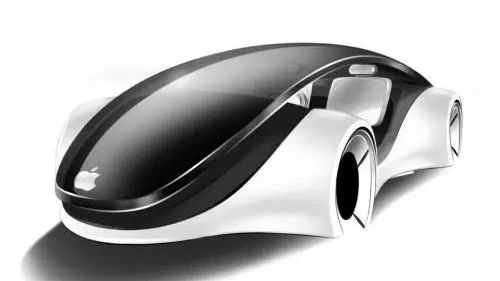

Is an iPhone-style premium product possible in the future of the intelligent automotive industry?

An iPhone-style product is something every enterprise dreams of: it achieves the best balance between price (brand), sales and profits.

As Apple pushed the mobile phone industry from the era of feature phones to the era of smartphones, it also pushed its premium product strategy to its extreme. According to the foreign media outlet, The Verge, Graham Townsend’s team, which was responsible for the camera technology in Apple’s iPhone, reached a scale of 800 people as early as 2015, with the team testing more than 200 independent camera performance scenarios for each iPhone.

The result of focusing the industry’s most elite talent on crafting a product is that Apple has become the world’s most valuable company.

Today’s automotive industry looks much like the mobile phone industry in 2007. All traditional automotive giants have complex product plans: Volkswagen Group will launch more than 80 electric vehicle models by 2025; BMW will launch 25 electric vehicle models by 2025; and General Motors will launch 20 electric vehicle models by 2023. For players who have been in the automotive industry for hundreds of years, the transformation of product strategy is harder than the transformation to electrification and intelligence. It is closely related to the operational mechanism and corporate culture of the enterprise and is deeply rooted.

The most critical issue is that before transformation to a premium product strategy, you must prove that the current “ocean of cars” product tactics are wrong.

Of course, the drawbacks of the “ocean of cars” tactics are obvious, such as the two car models of the same brand corresponding to a market and price range that are not completely separated, resulting in the problem of competition between them. This competition runs throughout the entire lifecycle of the two cars, from the design resources and research and development resources at the beginning of the product proposal, to the production and manufacturing resources, to the marketing resources after the launch, and finally to the maintenance resources. When the “ocean of cars” tactic is implemented across an entire OEM group, conflicts between products of different sub-brands will become more frequent, and the products born out of various restrictions and compromises will be far from the extreme, let alone a premium product.

But then, why are large car companies implementing the “ocean of cars” tactic? This phenomenon not only occurs in the automotive industry but also in the mobile phone industry. After Apple’s big success with the premium product strategy, few mobile phone manufacturers have followed suit.The most politically correct reason is that “different sub-markets have different needs”. Manufacturers launch targeted products for different sub-markets to better cater to consumers’ needs. This is true for both car manufacturers and smartphone manufacturers. Let’s continue with the iPhone as an example. Regardless of how well the iPhone performs, it cannot impress consumers with a budget of only 2000 yuan. In the early days, Apple completely gave up on the smartphone market with a price below 5000 yuan.

Although, later on, Apple partially solved this problem through the strategy of “benchmarking mid-range competitive products against old flagships” (currently, the price of iPhone SE on Apple’s official website has dropped to below 3000 yuan) to cover more sub-markets, this strategy is only possible with the annual product iteration approach that is much more efficient than the automobile industry. The efficiency of frequent iterations in the smartphone industry implies that successor products do not have much difference in user experience. However, for the car industry, where the R&D cycle for a single model can be as long as 48-52 months, it is worth debating whether benchmarking against mid-range competitive products with old flagships will be effective.

Let’s take a closer look at Apple’s true differential advantage compared to its competitors. It is actually the comprehensive user experience established through hardware and software collaboration. Apple’s operating logic: a high initial investment in the research and development of hardware and software collaboration, with further collaboration leading to the differentiation of Apple products from its competitors. This drives the highest level of profitability, which allows the company to cover the development cost of the next generation while earning disproportionally higher profits.

This flywheel effect has become the most powerful moneymaker for Apple for decades.

If you have been following Apple for a long time, you will understand besides the well-known A-series chip, Apple has done deep customized research and development work with its suppliers on all the key components of the iPhone, including screen, camera, battery, and vibration motor. Therefore, the comprehensive user experience of every new generation of iPhone can lead the industry by about a year (we can observe that in recent years, smartphone manufacturers such as Samsung, Huawei, and Google, who have been trying to collaborate hardware and software, have also produced excellent products).

Apple’s Senior Vice President, Phil Schiller, once said when introducing the MacBook:

At Apple, we believe the best way to make the best products is to design both the hardware and the software at the same time.> Apple firmly believes that only the integration of software and hardware design can create the best products.

It is this advantage that has led to a cumulative global sales of 222.4 million units for the iPhone 6 / 6Plus over its entire life cycle (the 6s series is still on sale), and one wonders how much upfront investment can withstand depreciation expense divided by 222.4 million units?

From 2007 to 2016, Apple sold a total of 1.2 billion iPhones, generating $738 billion in revenue for the company.

Back to the automotive industry, how should car manufacturers attempt to replicate the success of the iPhone’s explosive growth strategy?

The first step is to achieve software and hardware synergy, and the differentiated advantages established under this synergy are the basic conditions for incubating explosive products. On the other hand, the talent density, technical complexity, and upfront investment costs required for the software and hardware synergy in the intelligent automotive industry’s three electric systems and autonomous driving supply chain are two orders of magnitude higher than those for intelligent smartphones.

Secondly, unlike the iPhone, the explosive growth strategy for the car market cannot be achieved with a single car model alone. This is because the utilitarian nature of cars has a very important presence in product form. For example, if you need a Mini for commuting, a large 7-seater full-size SUV, no matter how good it is, can never entice you to buy. Therefore, a reasonable automotive explosive growth strategy should cover the most mainstream demands, like the iPhoneSE, iPhone, and iPhonePlus, with a full-size SUV, a compact SUV, a full-size sedan, a mid-size sedan, and an MPV.

As mentioned earlier, the cost of software and hardware synergy is very high and almost blocks the path of start-up companies; and for giants who lack neither money nor talent, the biggest problem is that the long-term enterprise operation culture mechanism is difficult to reform. Who will create the iPhone in the field of intelligent electric vehicles?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.

*

*