This article was written in May 2017, when Google collaborated with Volvo and Audi to release Android embedded hosts for vehicles. Looking back, some points remain relevant as references. Enjoy.

The automotive industry has been developing with incremental innovation for over a century. Recently, electrification and self-driving technology are bringing this aging industry back to the center of innovation. However, the field of connected cars, which is closely related to in-car experience, has yet to receive equal attention compared to the former two. In May 2017, Google teamed up with Audi and Volvo to release an embedded Android host operating system based on Android 7.0. We believe that this event will affect the future development of the in-car entertainment system market.

Why is “Electric Cars-2019, Autonomous Driving-2021, Connected Car Information Systems-?”

As mentioned above, the entire automotive industry is shifting towards electrification and self-driving technology, and it has become a consensus that almost all of the automobile manufacturers’ first electric cars will be launched by 2019. Correspondingly, most automobile manufacturers have set 2021 as the latest deadline for the launch of autonomous driving cars. In other words, 2019/2021 can be seen as the year of electrification and autonomous driving in the automotive industry. However, for the field of in-car entertainment systems, which is another area of change for the automotive industry, there is no clear timetable within the industry.

What causes this different development situation? Let’s first talk about what in-car entertainment systems are.

In-Vehicle Infotainment (IVI) is a comprehensive information processing system on the vehicle, which uses a vehicle CPU and is based on the vehicle bus system and internet services. IVI can achieve a series of applications, including 3D navigation, real-time traffic conditions, IPTV, assisted driving, fault detection, vehicle information, vehicle control, mobile office, wireless communication, online entertainment functions, and TSP services, greatly improving the level of vehicle electrification, networking, and intellectualization.

Many media outlets love to use Apple and Google since 2007 dominating the mobile electronic device system market with iOS+Android, as an analogy to predict the similar revolution in the IVI industry. Therefore, when Apple and Google released iOS in the Car (later renamed Apple CarPlay) and Android Auto in 2013, everyone expected another round of revolution.

But as the saying goes, the theory is bountiful, whereas the practice is difficult.Until May 2017, the IVI industry was still dominated by a few champions, including Microsoft WinCE, BlackBerry QNX, Linux, and Google Android (we will explain why Android has succeeded while Apple CarPlay has not). Despite the fluctuations in market share, the IVI market is not as interesting as the revolution in the mobile phone market.

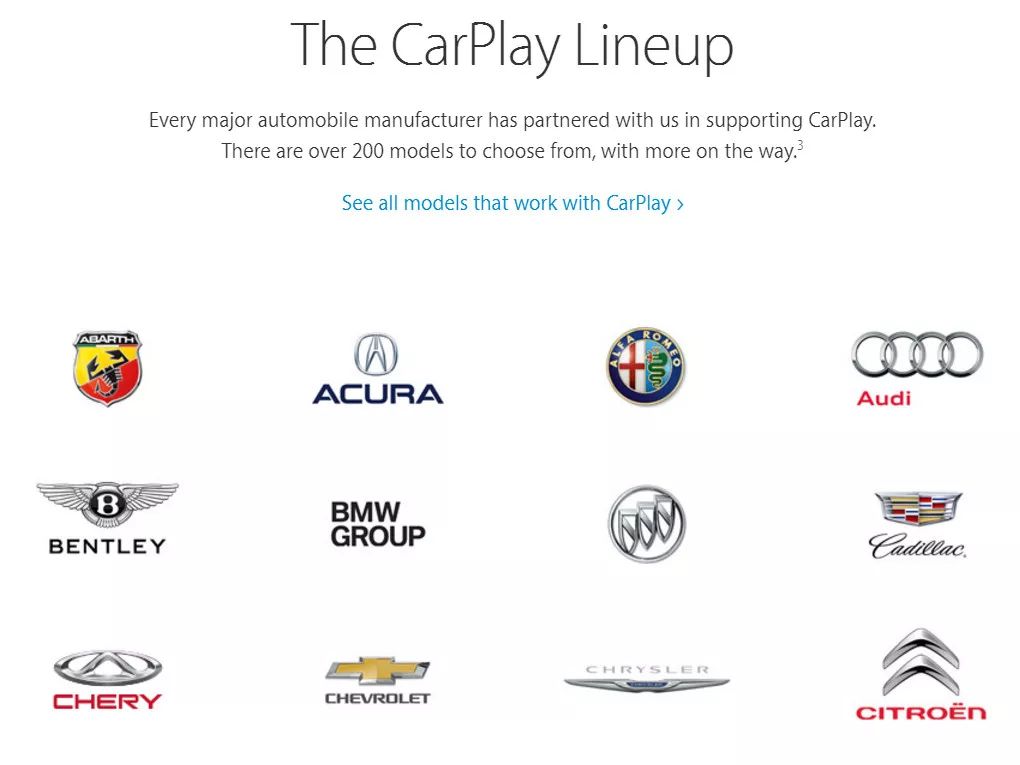

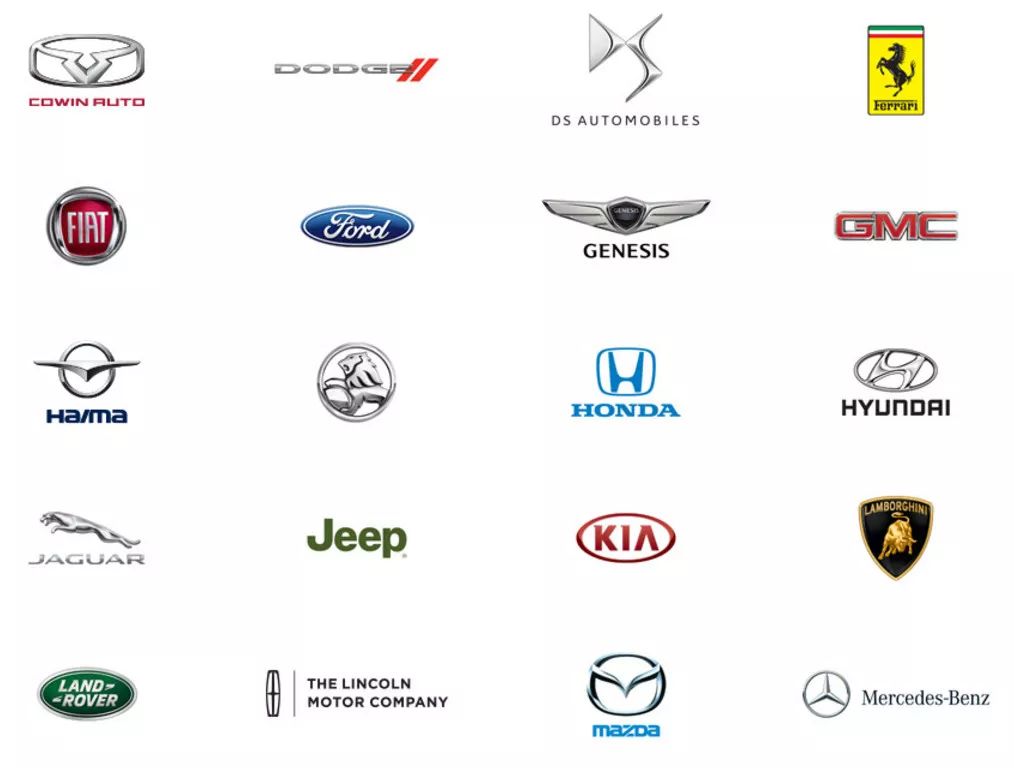

Some people attribute this to the resentment that the car manufacturers hold against the giants from the Internet industry, who are not willing to cooperate and open up user data to external partners. However, this claim is unfair, as more than just Audi and Volvo embracing Apple and Google. As early as December 2013, Google formed the Open Automotive Alliance (OAA) with Audi, General Motors, Honda, Hyundai, and NVIDIA. So far, the OAA has more than 50 members, including over 30 car manufacturers and over 10 automotive electronic suppliers. As for the number of car manufacturers that have joined the Apple CarPlay alliance, the official website lists over 80.

Therefore, the fact of the matter is that Apple and Google have been in the IVI industry for years, but they have not brought any killer experiences to the previous players, under the warm embrace of car manufacturers. It is undisputed that Internet companies are better at refining user experience than car manufacturers, as evidenced by the revolution in the mobile phone market. So, where is the problem?

We believe the first difference lies in the difference in usage scenarios between the two. It is inappropriate to compare IVI with mobile phones. Smartphones have made communication functions (specifically, making phone calls and sending text messages) less frequent in daily use, making entertainment functions such as games, videos, music, reading, and photography more frequent. However, the transportation function of cars always comes first, and no one wants to play a game like King of Glory on a car screen. It is more meaningful to improve the user experience of basic functions such as navigation, air conditioning, and window control than to add features such as “real-time news viewing”.Secondly, consumers, developers, and OEM feedback was not positive. Prior to Google’s official announcement to develop Android-based car infotainment systems, both Apple CarPlay and Android Auto were essentially implemented through mirroring the smartphone screen onto the car display. Automan CEO, Qingnian Shi, believes that “users need to connect their phones through cords or Bluetooth, click to connect, and only then start to experience the system. This user experience is tedious.” The poor user experience resulted in low usage rates among frequent users, leading to a decreased enthusiasm among developers, exacerbating the scarcity of applications and further cooling down the IVI ecosystem.

Another automotive internet industry observer stated that less than 1% of consumers list car infotainment systems as a key car purchasing factor. From the perspective of traditional OEMs, IVIs do not have as large an impact as autonomous driving technology. Newly developed systems that require large investments in manpower and financial resources have not received positive feedback in terms of revenue, resulting in a decrease in OEMs’ enthusiasm toward both systems.

However, with the convening of Google’s 2017 I/O Conference and other external factors, the entire IVI industry has experienced upheaval, and a revolution is on the horizon.

Why is Google’s launch of embedded Android-based car infotainment systems considered a call to a new revolution?

Even though embedded Android-based car infotainment systems were not released until this year’s developer conference, Google’s two-pronged mapping+infotainment system strategy in the IVI field has been around for a long time.

In 2015, when Android OS was upgraded to version 6.0, Google’s compatibility test criteria for partners already included references such as “Android Automotive,” stating that “Android Automotive can run on car infotainment systems and is an operating system. It can be part of the system only responsible for entertainment information, or it can be the entire system.”

This wording is completely different from the description of Android Auto, which mirrors the smartphone screen onto the car display. This criteria can be seen as Google’s first strategic shift in the IVI field.It is worth mentioning that due to the openness of the Android system, start-up companies dedicated to developing Android systems for vehicles have moved much faster than Google. In 2010, before Google announced its IVI strategy, domestic vehicle networking company BoTai developed the world’s first Android vehicle system, inkaNet, which was eventually commercialized on SAIC Roewe 350. With the help of Android Auto in 2013, start-up companies in the vehicle networking industry, such as Zebra Network and Jidou Technology, have already achieved significant commercialization in the front and rear loading markets with their Android in-car systems.

Wang Yifei, CEO of Jidou, a domestic vehicle networking company, has high confidence in the future of Android in-car systems. Vehicle manufacturers hope to install personalized IVI systems with brand characteristics. This is where companies like Jidou find opportunities. From the screenshots of the system published by Google at the developer conference and the custom systems developed by Jidou, there is indeed optimization space for the user interface and UI layout, similar to the optimization space of native Android and MIUI and Flyme in the mobile phone operating system.

Google’s official release of an embedded in-car Android host still has profound meaning. For start-up companies in the IVI field, Google’s transition in IVI strategy will play a significant leading role. As the spokesperson for the Android system, Google’s move will once again attract the attention of global developers to the IVI field and promote the prosperity of Android in-car hosts.

However, there is still a problem: even though the system is independent from mobile phones, and the user experience is no longer cumbersome, no one would want to play “Honour of Kings” on the large central touchscreen in their car. As mentioned above, there are significant differences in the mobile phone and IVI application scenarios.

This brings us to the “external forces push” mentioned earlier. To change the application scenario, we need to change the situation. As mentioned earlier, the earliest Level 4 autonomous driving is expected to be realized in 2021. After the driver and passengers no longer need to focus on driving, the car will become the third living space outside the home and workplace. This concept is reflected in the NIO EVE concept car, Volkswagen Sedic concept car, and the concept models of WeRide. Users can free up their hands and attention to do other things, such as playing games, watching videos, listening to music, reading, photography, etc. The interior layout of the car will also change from a purely seat+steering wheel combination to a living room-style layout with seats+small tables, or even sofas.

We believe that car manufacturers must also keep up with the trend and make changes. Under the influence of autonomous driving, user experience in the IVI field will increasingly impact car purchases in the future. The characteristics of traditional car systems like WinCE and QNX are slow development and synchronization with car R&D, but OTA air updates will become a basic and necessary feature in the future of automotive IVI. The Linux-based IVI system of Tesla even carries an empty function that will be pushed down later. Tesla CEO Elon Musk said, “Tesla cars will get significant updates every 12-18 months.” This brings the rapid development rhythm of the Internet industry into the automotive manufacturing field, commercializing new technologies faster, and is worth traditional car manufacturers’ reflection.

From an external perspective, the WinCE, QNX, Linux, and Android operating systems currently dominate the IVI field, but changes are happening. With the increasing popularity of smart interconnectivity, the shortcomings of WinCE are becoming more and more prominent. First of all, WinCE is not an open-source system, making it challenging to develop new functions. It is not intelligent enough, and implementing network functions is extremely difficult. Due to historical factors, the WinCE system design is not optimized for touchscreens and can only rely on physical buttons. These shortcomings are also reflected in its continually shrinking market share in recent years. QNX has high security from BlackBerry and relatively better adaptability to car-grade standards than Android, but expensive software licensing fees make QNX only have a certain market in high-end car models. At the same time, the high development costs are also QNX’s weakness. With Google’s official optimization and development support for car-grade systems, Android is expected to quickly eat away at WinCE’s market share and then turn to launch an attack on high-end QNX.

Of course, Android also has obvious weaknesses, such as the need to meet a series of car-grade safety standards for system stability. Besides, Android developed for mobile electronic devices is not good at controlling external devices. To control these devices, it is necessary to dock with the vehicle’s driving computer, CAN bus, OBD, and related devices. This requires in-depth restructuring of Android’s underlying architecture.At this point, you might have noticed that Apple, which is on par with Google in many aspects, seems to have not made a breakthrough in the IVI field. The market has given the answer. Apple CarPlay, which uses a mapping approach, has no future. However, pulling together a group of hardware partners is a task that Google is familiar with, but has never appeared at Apple. Apple has never authorized any system to a third party, and the development of integrated software and hardware is Apple’s gene. However, since last year, Apple’s first product to give up hardware development, Project Titan, has focused on software development. The automotive industry is considered to be the next industry facing tremendous change, and will Apple’s car OS become the first authorized operating system by a third party in Apple’s history? It is not impossible.

-

How to view the autonomous driving arms race launched by General Waymo?

-

McKinsey: Software Drives Rewrite of Automotive Industry Competitive Rules

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.