A few days ago, I wrote about General Motors’ heavy investment in the autonomous driving field. Today, I visited General Motors’ China Battery Laboratory and SAIC-GM Powertrain Development Center. In order to win in the fiercely competitive automotive industry in the future, the importance of electrification strategy is as significant as autonomous driving.

In all activities related to electrification at General Motors, the EV1 is displayed or mentioned. EV1 is an all-electric vehicle with a range of 120 kilometers introduced by General Motors in 1996. To be honest, General Motors is one of the few traditional automotive companies with technical accumulation in the field of electrification.

In fact, because of its role as a pioneer, General Motors, like Tesla, has delivered a large number of talents to the industry due to the popularity of electric vehicle startups in the past two years. For example, Peter Savagian, Senior Vice President of Product Development at Faraday Future, who built the FF91.

Before working for Faraday Future, he was actually the Chief Powertrain Systems Engineer at General Motors and was responsible for the powertrain systems of EV1 and Chevrolet Volt. After he left, General Motors launched the Chevrolet Bolt, which was put into production before Tesla’s Model 3 and became the first all-electric vehicle with both affordability and long range. This somewhat explains General Motors’ talent system and technical reserve in the field of electrification.

The Chevrolet Bolt is an interesting model and represents the victory of the soft-pack lithium battery camp. Prior to this, some unprofessional voices believed that Tesla’s long range was due to the high energy density of 18650 cylindrical batteries, and the mass production of the Bolt demonstrated that lithium batteries of different shapes (soft-pack, square, and cylindrical) have no great differences in energy density when grouped together based on a new platform for the development of all-electric vehicles.

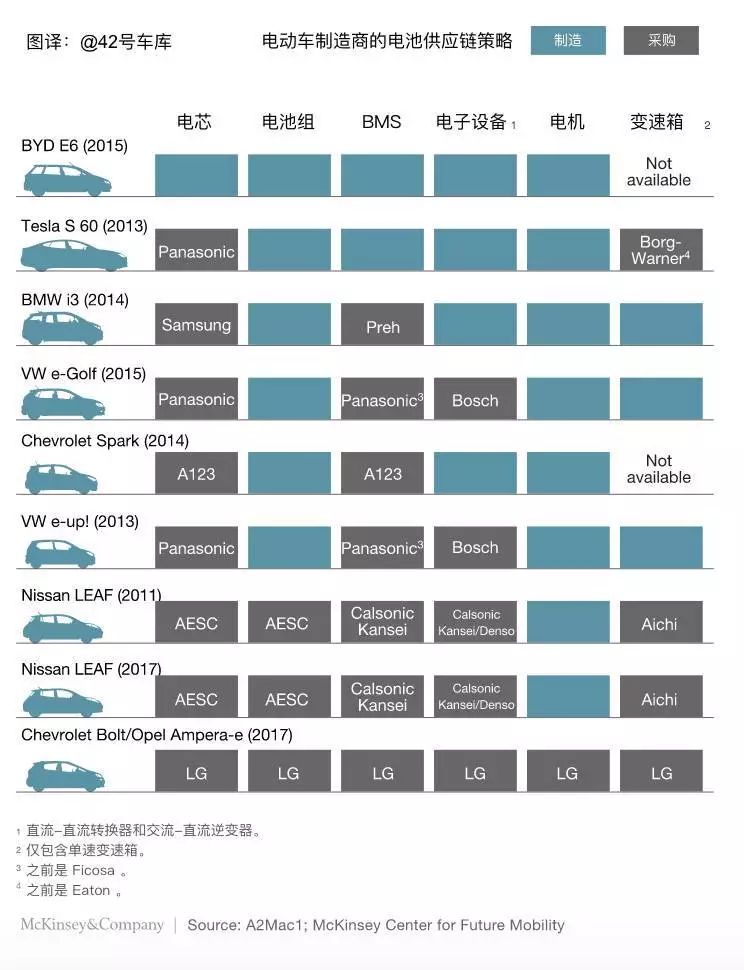

The next question is that McKinsey previously released a research report, which indicated that LG Chem was General Motors’ supplier for the Bolt’s battery cells, battery packs, BMS, electronic and electrical equipment, motors, and transmissions, while BYD and Tesla almost developed these components in-house. Therefore, does General Motors have an issue of excessive reliance on suppliers?

The existence of the General North American Lab and the Chinese Battery Lab is a response to this issue. According to the engineers, they will pre-research and test the performance, reliability, and durability of batteries, BMS, motors, and even the entire powertrain, and then output technical standards to LG Chemical and commission LG to produce components that meet the general standards.

Therefore, even for the components purchased from suppliers, General Motors also needs to do a lot of R&D and penetrate upstream in the industry chain.

General Motors previously announced its electrification strategy in China, that is to launch 10 new energy vehicle models in the Chinese market by 2020. Today, it also announced that it will deepen its electrification strategy and put 20 new energy vehicle models on the market in China by 2023.

Familiar with it? The electrification strategy of General Motors in the United States headquarters previously stated that “at least 20 new all-electric vehicles that will launch by 2023”, which also shows the position of the Chinese market in General Motors’ global market.

Speaking of the technical level, I saw two battery packs in SAIC-GM’s battery factory. (Because photography is prohibited, I can only describe it in words.)

A air-cooled pack consists of 2 modules, each module consists of 12 battery cells, and the capacity of the entire pack is 0.4 kWh. It started production in June last year and is mainly used for the power supply of the 48V mild hybrid system. 48V mild hybrid system has many advantages. The technical principle is to drive a higher-power start-stop motor under higher voltage, making it easier to drive the engine crankshaft, making the system work with less delay, less jerk, and lower energy consumption, summarizing it as “better driving experience, more fuel efficient.”

The other liquid-cooled pack also has 2 modules, each module has 52 battery cells. The capacity of the entire pack reaches 10.2 kWh and weighs 100 kg. The energy density of the pack is 102 Wh/kg. It is mainly used in hybrid models and is expected to be put into production in August this year. If you calculate the 48V mild hybrid and Chevrolet Bolt, you will find that General Motors has submitted completely different technical specifications for battery cells to suppliers for different product lines, built a whole set of battery technology system.Two battery pack production lines have achieved 100% electrification in terms of stacking and module installation, but the manual installation by workers is still the primary option for the final pack assembly due to the high number of wire harnesses, which make it difficult for robots to control and grip. The engineers admit there is no good solution to achieve fully automated battery production in the industry and relate the problem to the delays the Tesla Gigafactory caused in the Model 3 deliveries due to the issues faced in its fully automated battery production line.

Over the past year, General Motors has been advocating the importance of electrification, claiming it to be the future and priority. However, the attitude of the management is crucial for GM to achieve a breakthrough in electrification like it has in the self-driving field. Recently, the appointment of the new US EPA Administrator, a climate change skeptic named Scott Pruitt, has caused speculation about the relaxation of regulations on fuel emissions. In response to this, GM CEO, Mary Barra, posted a blog stating:

“Regardless of the changing regulatory policies, I assure you that we remain steadfastly committed to improving fuel efficiency, reducing emissions, investing in new technologies, and driving towards a fully electric future. This is the right choice for our customers, our company and our environment.”

This statement echoes Mary Barra’s commitment to pushing forward with self-driving technology with Cruise CEO Kyle Vogt. However, for GM, a traditional auto giant pushing for electrification is more challenging than self-driving. Early this year, I interviewed the GM global executive vice president and president of China, Matt Tsien, who expressed the view that investments in new businesses like smartification, electrification, and mobile travel can only be made when the traditional business (selling gasoline cars) is profitable and healthy.

The transformation to electrification and the operation of the current gasoline business are naturally conflicting activities for the automakers. The only way to make the transition is for the gasoline team to deliver excellent products and perform well in the market, which requires profits to be invested back into electrics, ultimately killing gasoline cars slowly.

This challenge is not only faced by GM, but also by every traditional automaker. Can GM, a company that is leading the charge in self-driving cars, successfully electrify in the future?

* How do you view the autonomous driving arms race sparked by Waymo, the leader in the field?

* How do you view the autonomous driving arms race sparked by Waymo, the leader in the field?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.