Best wishes to Ren Yuxiang and Zhu Xiaotong for success in their work 🙂

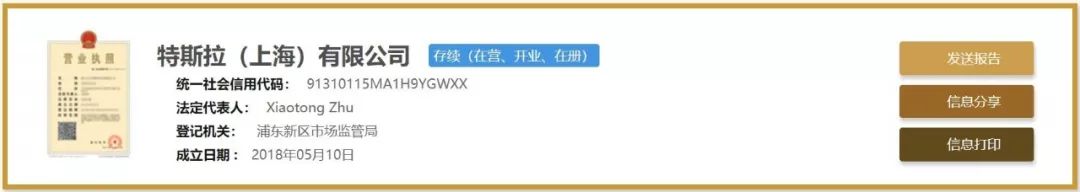

Today we’ll discuss two things. The first is that Tesla (Shanghai) Co., Ltd. has been granted a business license by the Shanghai Pudong New Area Market Supervision Administration. The company was founded on May 10th, 2018 with a registered capital of RMB 100 million. Xiaotong Zhu is the legal representative.

After this news was released, various interpretations followed. For example, this person named “Mr. Python” from Sina Weibo who refused to reveal his identity:

…Back to the topic, Xiaotong Zhu is the president of Tesla China, and together with Ren Yuxiang, Tesla’s global vice president and president of sales and services in Asia-Pacific, they brought Tesla’s sales in China from “unexpected weakness” (Elon Musk’s words) at the end of 2014 to sales of over $2 billion USD in 2017, accounting for over 25% of global sales, making China Tesla’s second largest market after the US.

He serves as the company’s legal representative, chairman, and general manager, so it can be confirmed that Zhu Xiaotong is the person in charge of Tesla’s landing in China.

Ren Yuxiang is the person in charge of negotiations between Tesla and the Chinese government on the establishment of a factory. He only said one sentence during Tesla’s Q1 earnings call, which lasted nearly an hour: “Negotiations with the government are going smoothly, and there will be some progress announced in the future.”

According to media reports citing “insiders,” Tesla’s Chinese factory has already begun construction in Shanghai, and adjustments will be made once restrictions on shareholding ratios are relaxed. Whether it’s true or not, it sounds pretty exciting for Tesla.

Take a look at the scope of the new company’s business: development, technical services, technical consulting, and technology transfer in the fields of electric vehicles and parts, batteries, energy storage equipment, and photovoltaic products… The biggest highlight is that, like what Panasonic’s president said two days ago, the research and development of the entire product line, including cars, batteries, and energy-related products like Powerwall and Solar Roof, will be established in China.

Does this mean that the domestic Model 3 is just around the corner?# Don’t Overthink It

Tesla’s production in China is destined to go down in history. According to Elon’s statement during the earnings call, Tesla is highly likely to establish a wholly-owned factory in China. This is not only a big step for Tesla, but also unprecedented in the history of China’s auto industry.

However, being unprecedented means Tesla China has a lot of issues to navigate. For example, setting up a strong government affairs team to handle the numerous and complex communications and approvals with government departments. A clear and present issue is that even locally established automobile manufacturing companies like NIO and WM Motor, each over three years old, had to obtain or are still applying for manufacturing qualifications via indirect means. Tesla’s qualification application may not be more smooth than theirs.

Especially since Tesla’s style has always been like this: on one hand California’s Vehicle Administration Office exited the annual autonomous driving car data report, and on the other hand Tesla announced they had collected 200+ million miles (in 2016) of road testing data. Or first releasing a car accident investigation report and causing dissatisfaction with the US National Highway Traffic Safety Administration, and even CEO simply withdrawing from the Presidential Economic Advisory Committee. If they continue this way in China…

Anyway, we suggest that Tesla carefully learn from Microsoft and Apple as positive examples, and take lessons from Google as a negative example. In the future, every session of the Wuzhen Internet Conference should have the CEO or core decision-making personnel actively participate in learning:)

Elon’s said that there will be more new developments to share at the next few seasons’ earnings conference. So, let’s wish Ren Yuxiang and Zhu Xiaotong smooth work.

Apple’s nth Acquisition of Tesla

The latest article about Apple’s acquisition of Tesla was published by US financial media company, The Street.

The first sentence of that article was written like this: One can dream, right?

Then, the author ranked Amazon’s acquisition of Sears, Microsoft’s acquisition of Netflix, and Apple’s acquisition of Tesla as the three major “dream mergers” in her mind.

Setting aside the clichés such as “Elon Musk is good at innovation”, “Tesla is under pressure in production capacity and financing”, “Apple has over $250 billion in cash reserves”, and “Apple has professional manufacturing and supply chain management knowledge”, this article discloses two new pieces of information.

-

Musk would “fully and unequivocally” accept the acquisition, even if “the acquisition price is lower than the current market value.”

-

Apple has conducted two due diligence investigations into Tesla in recent years in order to explore the possibility of acquiring it.

Why do I say that Apple’s acquisition of Tesla is a cliché? Google it and you’ll know.

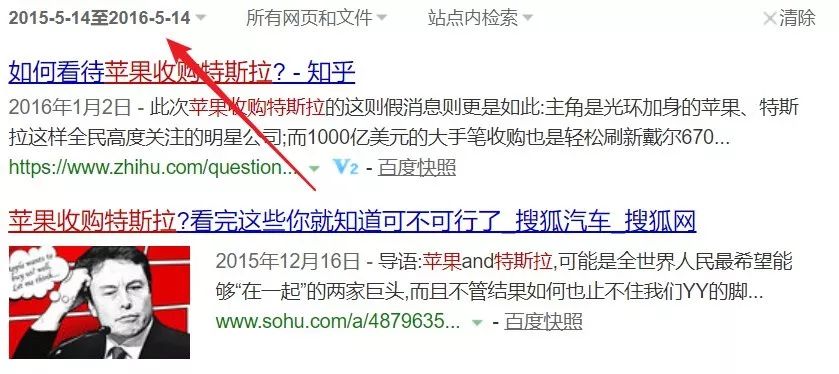

The following are the reports from 2014-2015, known as the “Apple should buy Tesla” year.

This is from 2015 to 2016:

This is from 2016 to 2017:

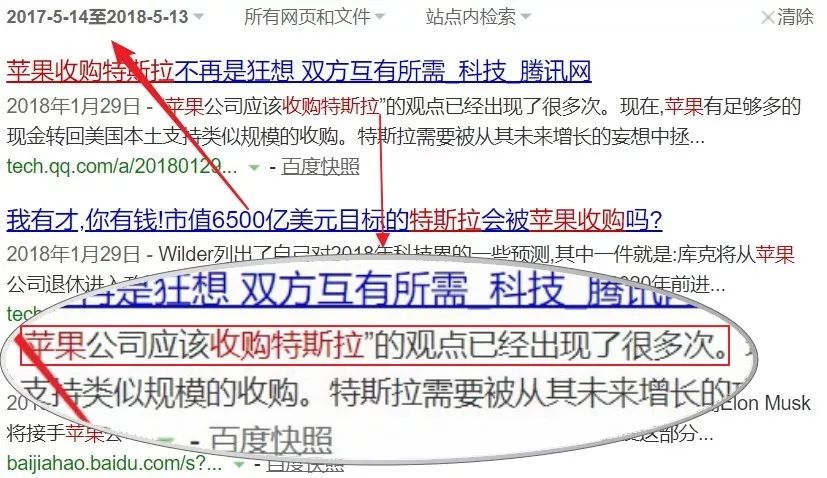

This is from 2017, before The Street’s publication:

Finally, this summary was well put: The idea that Apple should acquire Tesla has appeared many times.

The Street says Apple has conducted due diligence on Tesla twice, and the preceding sentence is “believe it or not, many Tesla employees have leaked information on blogs and forums,” what do you think?

And Musk will “completely and without dispute” accept the acquisition, according to a “Tesla expert” named Anton Wahlman.

When the news reached China, the media’s headline became this:

Chinese media is working even harder than The Street, always trying to make a big news.

The reason why the “Tesla expert” mentioned above believes that Musk will accept the acquisition is because “what he wants to do is Space X, that’s where his ambition lies. He doesn’t want to do the car business.”

In 2013, when sales of the Model S were sluggish and Tesla’s finances were stretched to the limit, Musk privately drew up a purchase offer with his friend and Google co-founder Larry Page, making it the moment when Tesla was closest to being acquired. But Musk still insisted on the harsh purchase conditions of “eight years of control after the acquisition or large-scale delivery of Model 3 production, and Google guaranteeing not to split up Tesla.” Do you think he “doesn’t want to do the car business”?# How does Musk think of the multiple acquisition proposals of Tesla from Apple?

Musk responded to the question in early 2014, stating that Tesla’s focus was on developing mass-market electric vehicles and that any acquisition scenario would inevitably be a distraction.

Let’s talk about the localization of Tesla.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.