Title

This is the title of Bloomberg’s latest article about Tesla, with the subtitle “The Complete Guide on How Elon Musk Raises and Spends Billions.”

Well, I just checked Elon’s Twitter and his mood seems stable. It’s unlikely for him to personally write an article and duel with the media.

However, the Q1 financial report will be released tomorrow, and it’s not a good thing to have such an article exposed at this time. So let’s take some time to see what Bloomberg has to say.

(The following translation includes deletions that do not change the original meaning of the article.)

“Elon Musk’s company, which was established to welcome the future of electric vehicles, may not have enough cash to survive this year.

Worrying about Tesla’s collapse is reasonable: no one finances and spends money like Elon Musk. No CEO of a publicly traded company would make a joke on Twitter saying “we are bankrupt” when the company is under tremendous pressure.

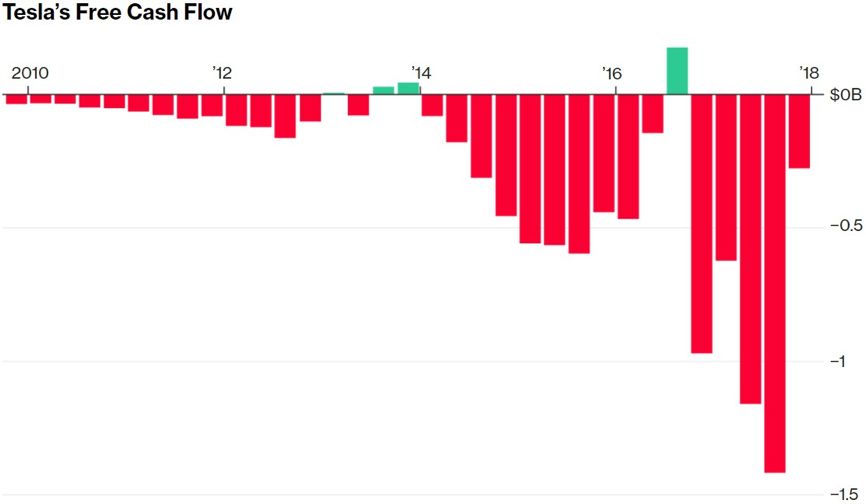

Tesla burns money so quickly that without external financing, this 15-year-old company may run out of cash in 2018. According to Bloomberg’s statistics, Tesla burns $6,500 every minute. Tesla’s free cash flow (the cash flow a company generates after covering capital expenditure) has been negative for five consecutive quarters.

This metric is worth paying attention to when Tesla reports its earnings on May 2.

Tesla’s only car manufacturing factory is located in Fremont, California, which produces three cars: Model S/X/3. In the coming years, Tesla also plans to produce electric semi-trucks, sports cars and compact SUVs. Although Musk has publicly stated that future factories will be fully automated, everything is currently dependent on manpower. In 2010, Tesla had only 899 employees; today that number has grown to almost 40,000.”

Now regarding cash flow, in a previous internal email sent by Musk, he wrote: “One valid criticism of Tesla is that you’re not a real company until you are, frankly. Another way of stating this is that a company must be profitable or cash flow positive to be considered truly viable. I have asked our finance team to comb through every expense worldwide, no matter how small, and cut everything that doesn’t have a strong value justification.”

Next is the factory. It should be pointed out that despite Musk’s obsession with thorough automation, hoping that the Fremont factory’s capacity can be increased ten-fold without expansion, the reality is that both the Fremont factory and the Gigafactory have been expanding. In addition, according to Musk’s remarks at last year’s Tesla shareholder meeting, the Fremont factory will only establish a trial production line for the compact SUV Model Y, and mass production will take place in a brand new factory.

The statement that “everything depends on manpower” is also somewhat biased. In the four major automobile manufacturing processes of stamping, welding, painting, and assembly, the automation rates of the first three advanced parts in any factory are above 95%. Even now, if the assembly automation production line is replaced with manual labor, Tesla’s factory automation rate is still leading in the industry.

The ongoing large-scale recruitment may exacerbate Tesla’s financial difficulties, as the rate of employee growth has outpaced its revenue growth for three of the past four years. This is mainly due to the acquisition of SolarCity and the production ramp of Model 3, which doubled the size of the workforce in 2017.

From 2014 to 2017, Tesla’s workforce has more than doubled, but employees’ income has remained stagnant. The average income per employee at General Motors and Ford is 2.5 times higher than that of Tesla. Tesla’s rapidly expanding workforce here does not even include employees of Tesla suppliers and second-tier suppliers, as Musk recently mentioned, like Russian dolls.

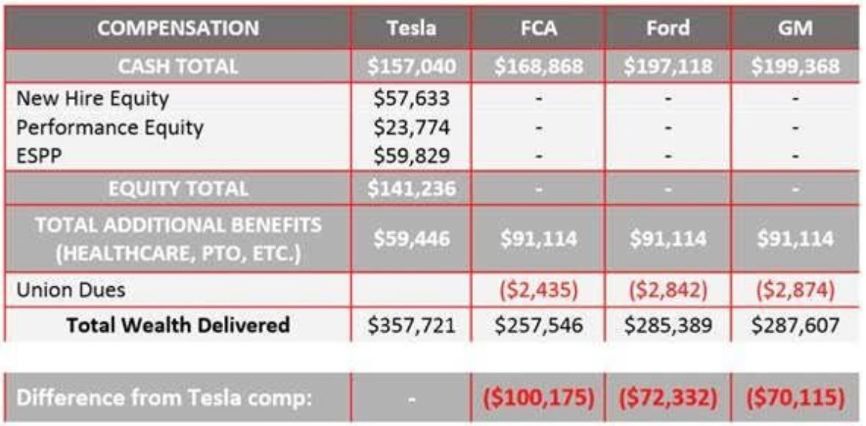

Putting aside whether it is reasonable to compare Tesla with Apple and Facebook, regarding employee income, Musk clarified last year when battling the union:

Unlike other car companies, Tesla offers stock incentives in addition to basic wages. In addition, Tesla employees can obtain stocks at a discounted price through an employee stock purchase plan. Last year, stock incentives increased significantly, and this situation will occur again this year once Model 3 production is good.

The chart below compares the total stock incentives received by Tesla production line employees since January 1, 2013, with those received by corresponding employees at GM, Ford, and Fiat-Chrysler during the same period. The reason for using a four-year period is that this is the length of Tesla’s stock incentive grant cycle for new employees. I believe that the stock incentives in the next four years will be comparable. As you can see, Tesla production line employees earn $70,000 to $100,000 more in total compensation than their counterparts in other American automakers.

“

Since its establishment in 2003, Tesla has been financing in every possible financial way based on the image of the CEO, and the company’s public image has always been the core of Tesla’s financing.

Since its first public offering in June 2010, Tesla has tried to raise funds through selling stocks, convertible bonds, monetization of leases, and floating garbage bonds, all of which can be done by any car manufacturer.

“Elon Musk is an engineer mindset, and he sees fundraising as one of the problems the company needs to solve,” said Andrea James, a former Tesla investor relations employee.

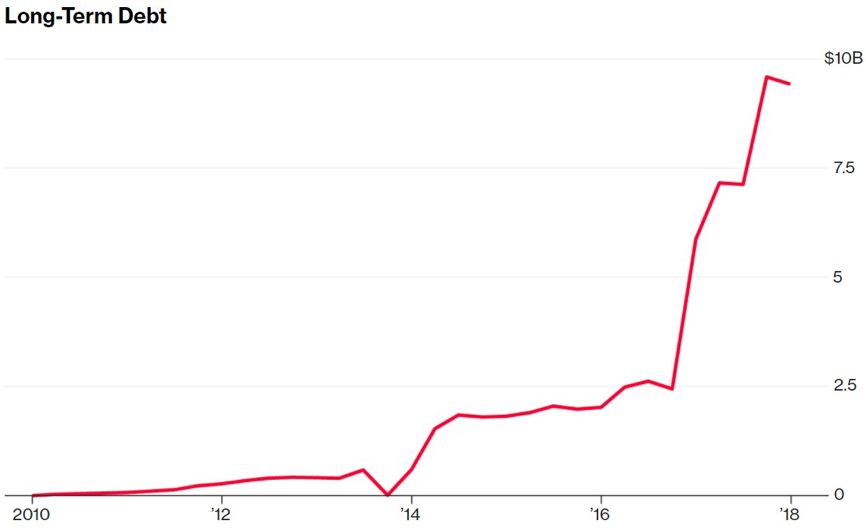

In 2017, Tesla held $3.4 billion in cash and had an unpaid debt of $9.4 billion. Many analysts believe that Tesla will need to finance again soon.

Bruce Clark, an analyst at Moody’s Investor Services, recently warned that Tesla will need to finance $2 billion this year, with $1.2 billion of existing debt due before 2019. Shortsellers firmly believe that Tesla is on the verge of unprecedented bankruptcy, and Jim Chanos, a well-known investor at Kynikos Associates, predicts that Tesla is heading for a collapse.

Cowen & Co. analyst Jeff Osborne predicts that Tesla will need to raise $3 billion in the Q4 by selling stocks and finance another $2 billion in 2019 to ensure the company’s cash reserves exceed $1 billion.

“

Financial issues are the most serious conflicts between analysts and Musk, without exception. As mentioned above, Musk said that Tesla has reached a profitable stage. As for whether they will finance again before being profitable, here is Tesla’s response: let’s wait and see.

“

(By the end of Q2, Model 3 production capacity will be up to 5,000 vehicles per week) The high capacity laid the foundation for Q3. The ultimate combination of good gross margin and strong operating cash flow will make Tesla not need to add equity or debt financing this year, except for standard credit.One of Tesla’s biggest advantages is its ability to gain support from customers and loyal fans through their patience and goodwill. As of the end of 2017, Tesla had raised $854 million in customer deposits.

Because Tesla uses a direct sales model without relying on a dealer network, customer deposits can actually be considered interest-free loans to Tesla, and these loans can last for several years. If Tesla were to go bankrupt, these deposits would be worthless.

Tesla has two unproduced car models that support deposit orders. The deposit for the Semi Trunk is $20,000, while the Roadster 2.0 is $50,000 (the founder’s edition is $250,000). Reserving a solar roof and home battery Powerwall requires a payment of $1,000.

Orders from Tesla do not exceed the deposit limit, but the vast majority of deposits currently come from Model 3 orders of $1,000. Due to lower than expected production capacity, the majority of the over 400,000 orders are still waiting.

There are also loyal fans who provide additional funding: some customers are willing to pay for optional features on vehicles, such as $3,000 for “full self-driving” – a feature Tesla has yet to deliver to any consumer.

“

Finally, I have a different opinion on this. There are rumors that the hardware cost of Tesla’s Autopilot 2.0 is $15,000, and even after mass production, the marginal cost will be difficult to be less than $8,000, considering the software development team’s spending. Looking at Tesla’s US website, the pricing for the enhanced autopilot and full self-driving is $8,000. Just considering the Autopilot, Tesla is not yet profitable.

“

Even after customers pick up their vehicles, Tesla can still generate financial benefits from the transaction. Tesla’s strategy of only producing purely electric vehicles can benefit from California’s zero-emission vehicle policy resources.

The California Air Resources Board (CARB) issued the ZEV (Zero Emission Vehicle) Act. CARB has established a credit standard for each category of EV, PHEV, and HEV, and set a credit benchmark tied to sales volume. Carmakers that do not meet the ZEV Act requirements must pay a fine of $5,000 per vehicle to CARB or buy credits from other companies.Since 2008, Tesla has earned more than $1.3 billion through the sale of credits. In 2017 alone, Tesla made $360.3 million from selling credits.

Of course, there are also Tesla stocks. Issuing new stocks usually dilutes existing shareholders’ equity, but it doesn’t affect Musk. He will maintain control by purchasing additional shares regularly. Currently, he holds over 33 million shares, which accounts for over 20 percent of Tesla’s stock. In comparison, Fidelity, Tesla’s second-largest stockholder, holds a 10 percent stake.

Tesla’s board of directors previously approved a ten-year CEO performance incentive plan, which rewards Musk with 2.03 million new shares of stock if Tesla’s market cap under his leadership reaches $650 billion by 2028.

This new incentive program ensures that Musk will continue to stay at Tesla. While he may serve as the Chief Product Officer, another person shall act as the CEO to run the company, though still reporting to him.

In fact, Musk’s enormous wealth is one of the reasons why many investors are willing to invest in Tesla. “Elon Musk has put all his money down,” said Ross Gerber from Gerber Kawasaki. Elon has become one of Tesla’s biggest bulls. “There isn’t any CEO in America that’s taking on the financial risk like he does.”

This is where Tesla enthusiasts and detractors agree: no other public company CEO assumes as much financial risk as Musk.

So, what is Tesla’s financial situation? I believe that at tomorrow’s Tesla Q1 earnings call, analysts are expected to ask this question. Additionally, Musk is expected to share news about the recently lowered Chinese tariffs, the expansion of stock share percentage and the progress of Model Y, which we all care about.

Let’s wait for tomorrow’s earnings call!* Tesla Model 3 debuts in Asia: Building the Future at $35,000 | Beijing Auto Show

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.