The highly anticipated 2017 domestic sales statistics in the industry have been released one after another.

Last year was another lively year for electric vehicles. Under this joyous appearance, how much progress have domestic electric vehicles made?

Let’s start with the overall sales figures.

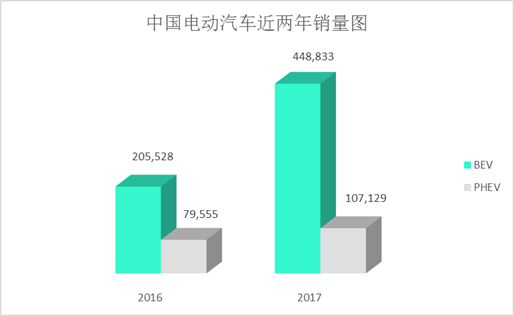

The total sales of electric vehicles (BEV + PHEV) in 2017 were 555,962, an increase of 92.3% compared to the same period last year. The total sales of electric vehicles (BEV + PHEV) in 2016 were 290,090.

In 2017, the sales of pure electric vehicles (BEV) rose significantly compared to 2016, with an increase rate of 118.4%! The growth rate of plug-in hybrid electric vehicles (PHEV) was also impressive, with a rate of 34.7%, but it paled in comparison to pure electric vehicles.

Everyone follows policies.

When the policy is to promote pure electric vehicles, everyone rushes to the road of pure electric vehicles without any ambiguity.

Who has grabbed the biggest share of the market?

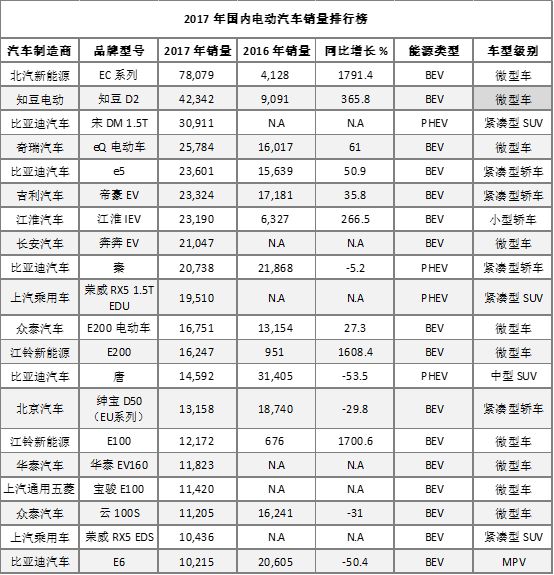

Here is the ultimate answer – China’s top 20 electric vehicle sales rankings for 2017.

Who had the best performance?

The answer is clear: Beijing Electric Vehicle Co., Ltd. EC Series, the biggest winner in the domestic electric vehicle market in 2017.

Not only did they rank first in sales, they also had the highest growth rate at an astonishing 1791.4%. Electric vehicles in the Beijing Electric Vehicle Co., Ltd. EC Series have two models, EC180 and EC200, both of which are sold at a subsidized price that can only be described as affordable: EC180 is sold at a price of 49,800 to 55,800 yuan, while EC200 is sold at a price of 56,800 to 62,800 yuan.

Affordable prices are popular in any level of city. Who can resist the temptation of low prices?

Beijing Electric Vehicle Co., Ltd., with its geographic advantage in the capital, is naturally favored. In this city where waiting for the license plate lottery to become a miracle, being able to buy a car is a blessing from heaven. The subsidy policy in the capital is also far ahead of other new energy vehicles.Just like that, the EC series gets a code name – National Electric Vehicle, thanks to its amazing sales performance. From less than 5000 sales in 2016, it skyrocketed to nearly 80,000 sales in 2017. The slightly larger micro electric vehicle (the EC series has a length of 3.675 meters and any car under 3.7 meters is a micro car) is priced very reasonably, and you can imagine how big the blue ocean of this price range is. But the range of the EC series cannot meet the new subsidy policy of 200 kilometers. Can it still maintain the status of the National Electric Vehicle without the subsidy? We must remain cautious because the competitors that follow are not to be underestimated. Following the EC series is the Zhidou D2. Although it ranks second, its sales have plummeted by more than 30,000 units. Zhidou D2 not only wanders around in the micro electric vehicle blue ocean at a reasonable price, but also has its own car-sharing company to support it. The gap between the top three on the ranking gradually narrows. The second echelon has representatives in various car model sectors, such as Chery eQ electric car and Changan’s Benben EV in the micro car sector. In the small car sector, there is JAC’s IEV. In the compact car sector, there are BYD’s e5 and Geely’s Emgrand EV. In the top 20 rankings, the most neglected micro cars occupy half of the list. If the range of micro cars can improve to 200 kilometers and continue to rely on subsidies, this blue ocean can still be enjoyed for a while. However, what about after subsidies decrease? We spent 20 billion, but still need to make SUVs.* What you need to know about this year’s CES auto show

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.