Who Drives Industry Change

**Source: Official Public Data

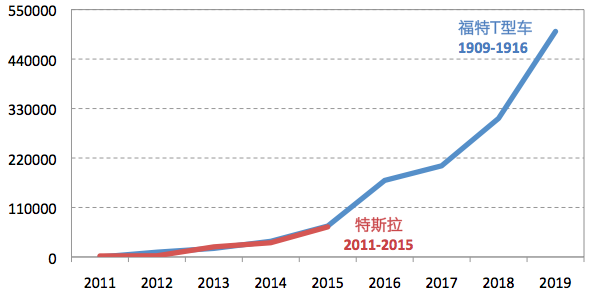

If you compare the sales of Tesla and Ford’s Model T after their market launch, you will find an amazing coincidence. Not only the growth curves, but also the sales data from 1910 to 1912 for Ford’s Model T and from 2013 to 2015 for Tesla are almost identical.

Both cars were innovative products on the market at that time, and these years were when they made the transition from budding to small-scale commercialization.

Whether they can drive industry change depends on whether they can smoothly pass through the large-scale commercialization stage. As we all know, Ford’s Model T did. In 1916, Model T achieved a production volume of 500,000, and Ford’s assembly-line revolution brought about a change in the entire automotive industry. Model T was later voted as the “Car of the Century” of the 20th century.

Similarly, Tesla plans to achieve a production volume of 500,000 by 2020. This production expansion plan is consistent with Model T’s on a cycle basis, but has been questioned by many people. Tesla’s development has not been as smooth as imagined, with production capacity crises, talent loss, delays in the super factory, and the death of the autonomous driving accident. Tesla’s news hotspots have been continuous.

For those who have confidence in Tesla, they believe that it has the conditions to disrupt with innovative and destructive products. Clayton Christensen, known as the “Father of Disruptive Innovation,” once said that mature companies generally have the ability to develop disruptive innovation products, but because these products do not meet the customer needs of existing value networks, mature companies will not choose to follow suit in large numbers, leaving opportunities for emerging companies. Once emerging companies become leaders in technological innovation, industry disruption inevitability begins.

One Tesla is not enough

Let’s take a broader perspective, from the production of cars to their use, it seems that everything has changed.

In March 2009, Travis Kalanick and Garrett Camp founded Uber in the United States, and through their continued efforts, they promoted the world into the era of shared travel. Also in 2009, Google began researching autonomous driving cars, with travel distances exceeding 1.5 million miles to date.Tesla, Uber, and Google, these three powers have jointly promoted the leapfrog development of products and demand, and the entire industry has entered a new turning point. While the replacement of fuel is still driven by the need for energy conservation and emission reduction, the lowering of technology barriers is conducive to the entry of new-generation manufacturers. Meanwhile, intelligent and shared mobility injects more imaginative future into new energy.

The meaning of the car has changed. It is no longer a traditional private car in the traditional sense. More and more private cars are joining the sharing industry. When the diverse travel needs from 0 to 100+ kilometers can be met, the boundary between public and private will be completely broken. Technology companies are eager to join this revolution.

What we can confirm is that the development of future cars will extend from here.

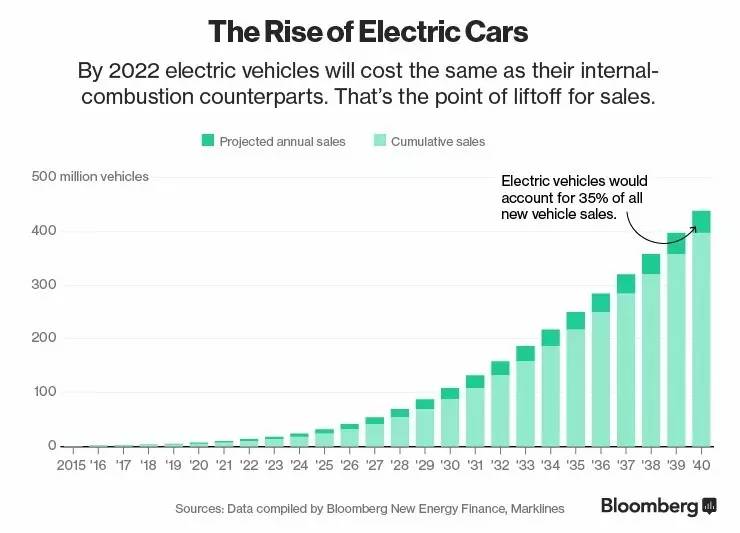

Possibly one third of cars will become electric vehicles.

Bloomberg predicts that the share of electric cars in 2040 will reach 35%. Goldman Sachs predicts that electric cars will achieve a market share of 22% within 10 years and the annual sales of electric cars will be about 25 million. In the 2025 plan announced by the Volkswagen Group, the sales volume of electric cars is planned to be between 2 million and 3 million, accounting for 20%-25% of the total sales volume.

As a senior executive of an automaker put it, electric cars are not a trend, but a reality. If you are skeptical about the predictions made by institutions, the predictions made by manufacturers are the most valuable reference because automakers need to plan products four to five years in advance, and the current sales plan has a major impact on future production allocation for the next five years.

This determination is related to the demonstration effect of Tesla. Automakers have realized that the performance of electric cars is catching up with gasoline-powered cars, and the electric car’s range is starting to meet some of the travel needs of people. The growth of electric cars will be faster than ever. Electric cars have been striving for more than 100 years and have finally waited for the opportunity to enter the front line.

Due to the lower maintenance costs of electric cars, electric cars will penetrate the B-side first and gradually influence C-side consumers. Liu Qing, the president of Didi Chuxing, stated at the China Internet Conference that the Didi platform will register 1 million electric cars within five years. If you often take a taxi in Shanghai, you will find that the probability of taking a BYD Qin or Tang is very high, and these vehicles are not for personal use, but are purchased uniformly by companies. Time-sharing leasing companies such as EVCARD have chosen electric cars as their service vehicles.

The cost reduction of batteries is an important prerequisite for the popularization of electric vehicles. Tesla’s plan is to use the Nevada Gigafactory as a starting point, reduce battery costs through supply chain optimization and scale effects. The successful launch of the Gigafactory will be an important turning point in the reduction of battery costs. Currently, the development of electric vehicles is closely related to various national policies. Governments rely on large subsidies to encourage people to buy electric vehicles, directly pushing up the sales of electric vehicles.

The development of electric vehicles is related not only to energy and infrastructure construction issues but also to the realization of overtaking in the car industry that people have been expecting for years.

Automakers face the transformation of transportation services

The future vision brought by shared mobility is that you don’t have to buy a car to have a more free way of transportation.

In 2015, the number of cars in China reached 172 million. The cities are becoming more and more crowded, and parking spaces are becoming harder to find. Drivers are becoming increasingly impatient. With the popularization of shared mobility and the upgrade of a new generation of consumer concepts, the next generation of young people may choose not to purchase vehicles, no longer simply “owning” vehicles, but establishing a “use” relationship with them. When diverse transportation needs are met, it is when car sales gradually decline.

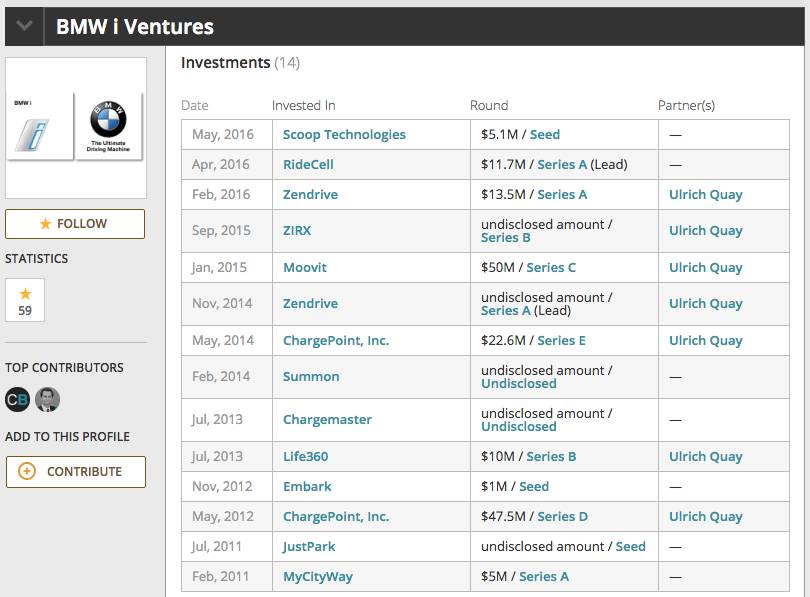

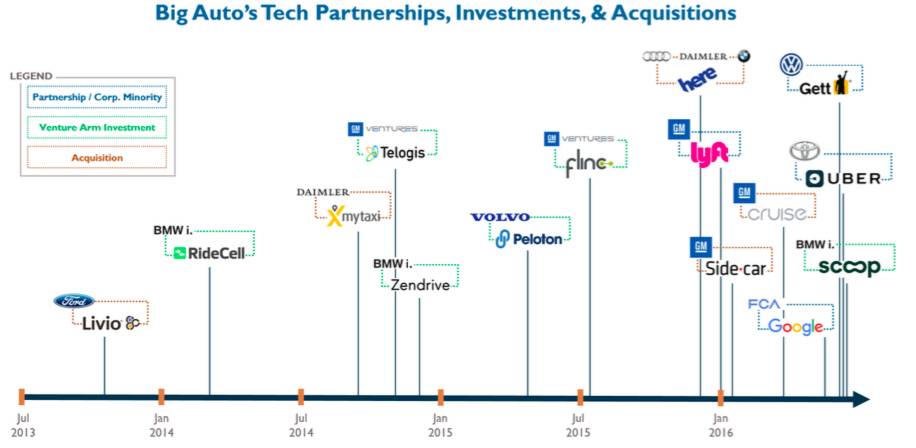

Once sales begin to decline, the profits of the automotive manufacturing process will be affected. Therefore, automotive manufacturers are actively considering transitioning from manufacturing to the service industry and exploring new sources of profit growth. BMW proposed a “first strategy” focused on transportation, emphasizing that the service industry will become BMW’s pillar industry and providing solutions for personal transportation. BMW also set up a special investment fund called BMW i Ventures, which is very active in investing in the transportation sector.

Investment projects of BMW i Ventures

In addition, each manufacturer is very active in investment activities in the field of shared mobility and has had plans for it for a long time.Daimler launched its Car2Go car-sharing service as early as 2009 and acquired taxi app MyTaxi in 2012; General Motors invested $500 million in Lyft and established its own sharing brand, Maven; the three major German manufacturers, Daimler, BMW, and Audi, acquired map supplier HERE for €2.5 billion; and Ford directly promoted itself as a “car + smart mobility travel company” on its advertising poster.

Source: CB Insights

Statistics show that cars are among the least utilized items in our daily lives. While we focus on environmental protection, we also pay attention to improving product efficiency, including energy conversion efficiency (electricity) to vehicle utilization. The popularity of the sharing economy fundamentally solves the problem of resource waste by reusing idle social resources. The future development of social organizations must be more energy-efficient and efficient at the same time.

When a car is shared to serve more members, the design standards for the car will become more universal, the configuration will become simpler, and the needs of multiple people traveling will be met. The more private needs, such as driving pleasure, will also develop synchronously to serve more precise and niche customer groups.

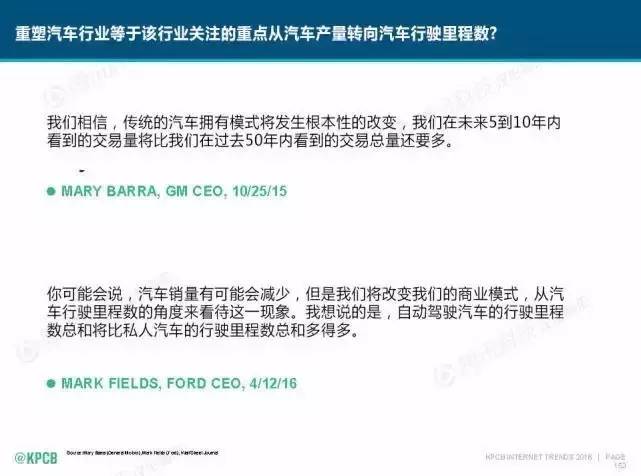

Core data indicators are beginning to focus on vehicle mileage

Source: Internet Queen Report

As we pay more attention to transportation, mileage, an important indicator, will also be included in the vehicle evaluation standards. When Li Xiang, the founder of Chehejia, talks about the company’s development direction, he no longer talks about the number of vehicles for a particular group of people at what price, but about what kind of vehicles to use for 30 kilometers and for 100 kilometers.

The next stage of the automotive industry will shift its focus from vehicle sales to vehicle mileage. Vehicle mileage will become the basis for personalized data and will be stored in the cloud.

The business model of car insurance may also change as a result. For example, UBI car insurance (Usage-Based Insurance) is based on data such as vehicle mileage and driving behavior of the owner, which is used to develop personalized premium standards. For companies with operational nature, cloud-based access to mileage data will be more conducive to the calculation of operating data. In addition, the transparency of mileage will make it easier to standardize the condition of second-hand cars.Changes in transportation usage can also lead to policy changes. Governments can optimize road traffic congestion by setting tax standards based on mileage usage (road use rate).

The Era of New Platforms for Automobiles

With changes in automobile fuel and fewer parts used, the layout of vehicle space will change, and the exterior design of cars can be more imaginative. Additionally, lightweight design is more emphasized in car body design. The upgrades in car networking services and the introduction of automatic driving (advanced driver assistance) functions indicate that cars will enter a new platform era.

This platform includes two aspects: a new product platform and a new service platform.

The BMW i brand’s “LifeDrive” structure can help you understand the new electric car platform. Life and Drive are two different modules. The Drive module carries the battery and motor structure, which is the core component of an electric vehicle and also plays an important role in vehicle weight distribution. The Life module can be more personalized, providing a broader and freer space. In addition, with the development of automatic driving technology, the Life module also needs to address the arrangement of cameras, radars, and sensors.

The involvement of manufacturers in the field of shared travel has an impact on data collection for shared travel, which can be important references for vehicle design. The tool properties, identity attributes, and interest attributes of vehicles will slowly be stripped away. Relevant data on vehicle usage, such as travel distance, luggage space, number of passengers, driving speed, and mileage, will continue to accumulate, allowing manufacturers to better meet the daily needs of consumers in product planning.

Currently, the product development process is led by the vehicle manufacturer and coordinated by suppliers. After the product is produced, it is sold, and there are automaker dealerships, sales, after-sales, finance, and used car services. The complexity of automobile product sales determines the need for partners to join, though different partners may have different names and methods of cooperation, making it difficult to have significant breakthroughs in the short term.

Intelligent Vehicles: Starting from Car Networking and Automatic Driving

An easily understandable intelligent scenario is driving to a shopping mall, and before arriving, the vehicle recommends restaurant information and automatically arranges a reservation for you. When you arrive, the vehicle selects a parking space and automatically parks and shuts off the engine. After finishing your meal, you can summon the vehicle on your phone, and the vehicle automatically drives out with the air conditioning and seat position already adjusted to your personal preferences.

An easily understandable intelligent scenario is driving to a shopping mall, and before arriving, the vehicle recommends restaurant information and automatically arranges a reservation for you. When you arrive, the vehicle selects a parking space and automatically parks and shuts off the engine. After finishing your meal, you can summon the vehicle on your phone, and the vehicle automatically drives out with the air conditioning and seat position already adjusted to your personal preferences.

Multiple functionalities are involved in this scenario, such as map navigation, voice technology, and data digitization of lifestyle (catering) information, as well as closed parking lot self-driving. The vehicle’s intelligence requires the digitization of different information and the improvement of various software services to achieve it.

However, a question arises: do we really need vehicles to become more intelligent? Or is vehicle intelligence just an optional feature that does not provide us with much convenience in our daily lives?

In Google’s self-driving car promotional video, older people were invited to experience Google autonomous vehicles. Each elderly person who rode in the Google autonomous vehicle eventually smiled happily. After watching the promotional video, it is clear that self-driving cars can provide more convenient travel for more elderly and disabled people who are not comfortable with driving. This is something that young people who desire to experience a car’s accelerating performance at the racetrack cannot imagine.

According to data from Uber, the unit cost of Uber is $2.8 per mile, of which 80% of the cost comes from drivers. After achieving the highest level of autonomous driving (L4), the cost can be reduced to $0.53 per mile. In other words, autonomous driving can reduce the company’s operating costs and cause a group of drivers to become unemployed. Additionally, self-driving makes shared travel more convenient, reduces costs, and increases passenger capacity.

Singapore, Luxembourg, and Amsterdam have recently proposed that fully autonomous travel services should be implemented in 2-4 years. NuTonomy, a startup separated from MIT, plans to pilot fully autonomous taxi services in Singapore’s industrial park one-north. Advertisers are excited about the era of driverless cars, where more in-car time is available, meaning more room for media content and advertising.

After Tesla’s self-driving accident, the industry has become more cautious about promoting autonomous driving, which is a good thing. I can imagine that in the farthest future, each person will have their own living space, their travel rights will be respected, and everyone will be free to enjoy the pleasure of travel.

Although the transformation of automobiles may not be coming as fast, it is already upon us.▼

Let’s explore together

Strowbel talks about how Tesla is restructuring the grid system of this century.

Why are internet giants investing in the automobile industry?

Five key issues that are impacting Tesla

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.