After a long holiday and traveling to many places, I am finally back to finish this article today, sorry for the delay.

Many friends and netizens participated in the discussion of this article, which was very interesting. Unfortunately, I couldn’t reply to everyone, and I hope that those whose opinions differ from mine can understand. I deleted and blocked some people, and I hope for your understanding.

One friend, “Li Zi from Tiexi District”, published a relevant article on “JiaShipai” after reading my article. The link is as follows:

Shidian | Different Views on Tesla from Yiran: Tesla Can’t Become Apple

This kind of exchange and debate is like a resurgence of an ancient road, very interesting.

In my previous two articles, I talked about Tesla’s high-end brand positioning and short product line layout. Today, I will talk about the sub-market where the product line is located.

Mr. Bartman believes that Tesla specializes in electric vehicles, and this sub-market is too small, which restricts the company’s development space.

I admit that electric vehicles are very niche for the overall automotive market, but Tesla’s approach may not necessarily be wrong.

Subversion often comes from the edge, and revolution often starts from the grassroots

Mao Zedong’s army did not compete with the ruling party in economically developed and densely populated cities; when Apple started making phones, touch-screen phones were also a small niche market; Qualcomm became a chip giant by seizing the rise of mobile devices. Before that, the only answer to our chip giant was the classic “Intel inside”;

In recent decades, great political and economic changes in China have also often been born in those inconspicuous small places- Xiaogang Village, Shenzhen (the “fishing village version” of Shenzhen), Wenzhou (the poor Wenzhou of the past), and Shanghai Pudong New Area (the “prefer Puxi for a bed, not Pudong for a house” version of Pudong).

It is in these small places where traditional forces do not focus or have no interest that innovative and representative products for the future often sprout. Only in these cold places where no one cares about and where the dark and stubborn traditional forces are not strong enough can you have a chance to wield the holy sword of the knight of light and write a song of ice and fire.

Nissan-Renault, GM, and Ford have all invested a lot of energy in electric vehicles, especially Nissan’s electric vehicle strategy is the most radical among traditional automakers.

However, there are several weaknesses of traditional car companies in making new energy products:

-

It is difficult to fully mobilize internal resources because the focus of the board of directors is undoubtedly on traditional energy products that account for 95% of sales revenue.

-

When a Leaf electric car is displayed in the showroom with 10 other gasoline cars, which one is more likely to be chosen by customers?

-

Traditional car companies will inevitably use the traditional way of making cars to make electric cars, so Leaf’s product is not much different from the electric version of Nissan Tiida (a compact two-box car that has been discontinued in the United States), except for the significant weakness of having to recharge after running more than 100 km, but the price has almost doubled due to the high cost of new technology.# The Issue with Nissan, and the Rise of Tesla

GM, Ford, and VW are not exempt from the issues that plague Nissan. (In my personal opinion, BMW i Series is the only electric vehicle from traditional carmakers that truly sparks my desire to purchase. BMW did an amazing job with creating a new series and design language!)

Traditional carmakers haven’t been doing a great job, which is why Tesla had the opportunity to rise.

But Tesla themselves barely survived, coming close to bankruptcy multiple times.

The world doesn’t need another new player without distinctive characteristics

Today, it’s hard to imagine a new car startup releasing a few gasoline cars and then attempting to challenge Toyota, VW, GM, and BMW, because that’s almost unrealistic.

And even existing companies are struggling.

For example, in the Chinese market, there are countless domestic brands that are still alive, mainly because of these four reasons:

- The Chinese market is huge and has long-term, rapid growth, allowing for many players to enter.

- China’s automotive industry policy hinders foreign brands.

- As an underdeveloped country, China has significant demand for low-end, economical cars, and local brands have an advantage in this aspect.

- Local governments have protection policies and subsidies for domestic enterprises.

These domestic brands are still on the path of entrepreneurship, but except for a few outstanding ones, it’s hard to see them surviving in the car market in the long term, because all the factors that are beneficial to them will gradually disappear.

New entrants, like China’s Qoros and Europe’s DS, struggle after their initial success.

Globally, Mitsubishi and Suzuki in Japan are already struggling, Tata in India is losing momentum, Fiat, PSA, and Renault in Europe are continually losing money, and although Chrysler Group’s sales and profits are growing, there are many hidden dangers.

Overall, traditional carmakers’ numbers are decreasing.

There are already many car brands in the world, so why add another one without any distinctive features?

I believe Musk also thought about this question, which is why he wanted to create a brand that has a very distinctive and unique image – and thus Tesla focused on electric cars. I wonder if Mr. Thomas would tell us, if Tesla had also produced gasoline cars, could it still be the market star it is today?

Marxist philosophy teaches us to view problems through a developmental lens.

Small shrimp can grow into large lobsters, and small markets can become dominant players.

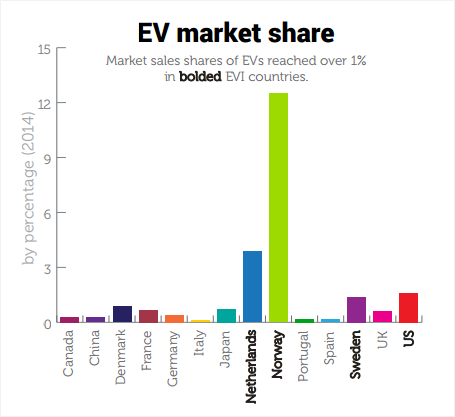

The electric car market is small, and to date, global electric vehicle shares are less than 1% of the overall automotive market.

Data from various countries’ electric vehicle market share in 2014.

But the more critical issue is:1. Is there any growth potential in this market? Is investing in electric vehicles the right direction? (Strategic direction)

-

If the direction is right, when should we enter? (Timing of market entry)

-

After determining the timing of entry, how should we enter? (Specific tactics)

Our previous discussions about Tesla’s positioning, product lines, and focus on electric vehicles versus traditional power are actually tactical issues.

Specific tactics are very important, but the direction and timing of bets are also important before making a move.

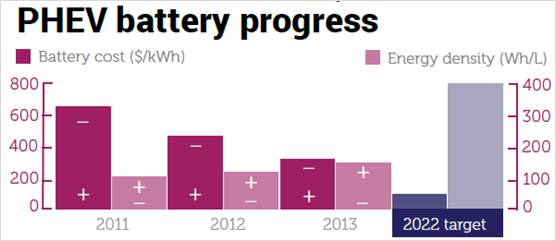

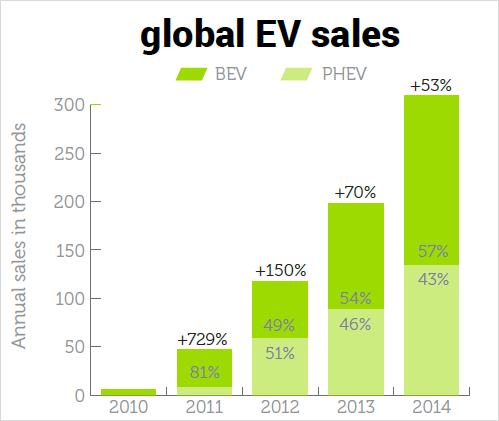

Emerging technology directions like electric vehicles have indicators that change rapidly every year: such as battery energy density and unit cost, which in turn affect sales changes. In addition, there are various factors such as national policies, infrastructure construction, and international oil prices.

In short, judging the appropriate time to enter is like judging the bottom in the stock market, which is by no means an easy task.

Image data: Trends in battery costs and energy density

Image data: Global electric vehicle sales trends

Musk is obviously a proponent of electric vehicle direction. In fact, electric vehicles are basically the consensus judgment of major giants, but everyone’s views are slightly different. For example, Toyota, because of its strong hybrid capabilities, is relatively indifferent to electric vehicles, and invests more in more advanced technologies such as fuel cells.

In terms of technology routes, Tesla is in line with the trend.

In terms of investment timing, Tesla and Nissan, and GM are relatively more aggressive electric vehicle manufacturers. While Volkswagen, Hyundai, BMW, and most other large factories are relatively conservative.

The wait-and-see attitude of traditional automakers is completely understandable:

First, the tangible and intangible assets they own are derived from internal combustion engines. The engine is the most critical core technology of a car company. Once the technology route changes, it is equivalent to giving up past asset accumulation.

(Actually, this is also one of the reasons why the Chinese government especially encourages everyone to make electric vehicles, because the government does not believe that our companies can catch up with foreigners in traditional power, and the gap in new energy is relatively small.) Moreover, investing in electric vehicles is a huge expense. If it is launched too early and the market is not ready to start, it may face huge losses.

Nissan can be regarded as the most aggressive and ambitious traditional automaker. (GM is slightly more conservative. They have invested heavily and created Volt, but still retain internal combustion engines.) In the era of traditional power, they will always be subservient to Toyota internally and hope for General Motors, Volkswagen, and Ford externally.## However, Carlos Ghosn wants to seize the initiative by setting up Nissan as a leader in the new era of motoring

By planting the flag of EVs as Nissan’s new corporate symbol, he is defying the expectations of the global consumers and taking the lead in energy-efficient vehicles ahead of his rivals.

Like Carlos Ghosn, Elon Musk’s forward-looking and ambitious attitude offers a similar vision. However, Nissan’s approach is very different from Tesla’s and in the short term it appears to be lagging behind. Nevertheless, the 2016 release of the second generation of the popular Leaf carries with it six years of experience and research in EV technologies. It is possible that the competition between the traditional car brands deciding which one will come out on top of EVs is far from over.

According to 2015 US sales data, (including pure EVs and other hybrids), Tesla’s Model S, despite being at the high end of pricing, earned them the top sales with a 22% share of the EV market. Nissan’s Leaf came in at a steady second place.

The future of EVs is yet to be determined largely because the auto market is following a costly technological trend. It is hard to predict how the growth of EVs will be impacted long-term by low oil prices and the weakness of public charging infrastructure. We don’t know how quickly battery technology will continue to evolve either.

All of these questions will impact the people who are betting on EVs.

Conclusion

We began this series of articles after reading Thomas’ contribution to the Harvard Business Review. It was a very influential publication, but we feel as though some of the contents were somewhat careless.

Secondly, we frequently hear friends and colleagues inquiring: “What is Tesla doing exactly? They don’t have any core technologies, just some distinctively assembled parts. Companies like Toyota, GM, Volkswagen, and BYD can easily create something similar to the Model S.”

In fact, the original purpose of vehicle assembly vertically integrates the industry chain. An automobile is such a complex product that the ability to rely upon suppliers is necessary, and to make good use of them undoubtedly reflects the automaker’s abilities.

Lastly, having the ability to manufacture a product is one thing, but being able to run a successful business with said product involves other, entirely separate skills. One might imagine that selling hamburgers and fries, or more designed simply, carbonated beverages might be done by anyone–but why has McDonald’s emerged globally as the most successful business of its kind?Due to the recent trend of internet carmakers in China, such as Fisker Carma backed by traditional automotive supplier Wanxiang, as well as LeEco, Next EV, Tencent (in partnership with Foxconn and Harmony Auto), and others, many internet capital firms have flooded into the vehicle manufacturing industry under the guise of electric vehicles. It seems as though creating an electric car is a simple task.

This phenomenon of great strides forward (regardless of right or wrong) has prompted my thoughts on the development trends of electric and future automotive products.

An internet friend from Beijing once told me at the beginning of the year on Zhihu (Chinese Q&A website), “If we produce an intelligent electric car, using Xiaomi’s explosive marketing strategy and cost-effective pricing strategy to first gain users, then wouldn’t it quickly become popular?” I hope that internet capital entering into the car manufacturing industry now will not underestimate the high threshold of electric vehicles and be too optimistic.

No matter if the car is electric or not, creating a car is not an easy task. One must fundraise large amounts of capital and manpower, establish a complex supply chain, and collaborate with all parties involved in creating a product that encompasses over tens of thousands of individual parts. The engineering complexity is ten times greater than that of a cell phone.

Tesla, as an outsider new to the field, was incredibly daring in innovating the car’s structure design, yet it did not result in frequent breakdowns on the road. I think this is truly remarkable.

Many people in the comments complain about Tesla’s rough interior craftsmanship, leaking sunroofs, and poor customer service at their dealerships.

I cannot deny your individual experience. However, I can only say that complaining is easy, and especially so online.

For instance, I often complain in my mind about Taobao and Tmall’s visual design, which I think is terrible compared to Amazon’s experience (who can deny this fact!?), but they are about to set a new global e-commerce record on Singles Day (November 11th). I guess for someone like Jack Ma, he doesn’t pay attention to complaints like mine.

Alibaba’s goal is probably to constantly break records and continually improve themselves.

Follow Yiran’s Car Talk – Zhihu专栏 (in Chinese)

October 18, 2015, Shanghai

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.